About three weeks ago I was asked a question out of the blue that caught me by surprise because it came from someone I didn't know very well--- if you could take a flier on just one investment right now what would it be?

While I hesitated, my father-in-law who was with me piped up with his suggestion of gold. His justification was in part the already large run up in price, the Fed's easy money policy, the poisonous political environment and that gold is real money, not a fiat currency. I didn't debate him on his points, but stated it wasn't my style to buy things so close to their all-time highs.

My style is to take a flier on something that seems to be universally hated because the upside potential is much greater. So I piped up with Bank of American, which everyone hated at the time, and still seems to. I heard the groans right after I mentioned the name, and got the abrupt: "Really, aren't they going under?" I knew this person was going to be buying gold soon, and will probably get caught in the coming gold correction within the next year or two.

At the time, BAC was selling at close to 6 bucks a share, with major challenges in every line of business and despised by most investment professionals, some who joking called it "Dead Bank Walking." The situation couldn't be better for making an investment in their great collection of assets. Pessimism was running high; rumors of demise were all over the news media. Perfect flier territory.

Then came the Buffett deal, where the Oracle purchased some preferred and options to buy common at fire sale prices. The management of BAC have a history of negotiating bad deals that penalize shareholders, and this is another one of those deals. The Wall Street Journal, and a number of blogs such as MoneyCone and DIY-Investor have warned folks not to blindly follow Buffett into this deal by looking at the results of investing in common on his other deals of the past three years. It isn't a pretty picture, and no one knows, not even Warren, the true financial condition of BAC after buying Countrywide and Merrill.

My guess is that in five years BAC common will either be at 0 or the mid-twenties. Banks can recover amazing fast when the tide turns on the housing market. Is it worth plunking down $1200 bucks for a return that could either be 0 or $4800 or somewhere in between. No one can predict the future, and you'll have to make that decision for yourself. Me, I'd be inclined to throw a little crazy money into BAC betting on a three, four or five bagger not because of the Buffett investment, but because of the extreme pessimism surrounding the stock.

If you could take a flier on just one investment what would it be?

Disclosure: The Grouch does have a small, speculative position in BAC taken before Buffett negotiated his preferred deal.

Wednesday, August 31, 2011

Monday, August 29, 2011

Economists, Mano a Mano

University of Maryland economist Peter Morici writes in a CNBC editorial on the Economic Impact of Hurricane Irene:

"Rebuilding after Irene, especially in an economy with high unemployment and underused resources in the construction and building materials industries, will unleash at least $20 billion in new direct private spending-likely more as many folks rebuild larger than before, and the capital stock that emerges will prove more economically useful and productive.In what can only be described as a brilliant counterpunch, George Mason economist Don Boudreaux writes in his open letter to Peter Morici:

This is not to discount the direct costs to individuals by temporary and in some cases permanent displacements; however, when government authorities facilitate rebuilding quickly and effectively, the process of economic renewal can leave communities better off than before."

"I hereby offer my services to you, at a modest wage, to destroy your house and your car. Act now, and I’ll throw in at no extra charge destruction of all of your clothing, furniture, computer hardware and software, and large and small household appliances.The Grouch: Morici jumps the Krugman with his editorial and Boudreaux slams him right back with an up close and personal exploration of the Broken Windows Fallacy. Absolutely brilliant.

Because, I’m sure, almost all of these things that I’ll destroy for you are more than a few days old (and, hence, are hampered by wear and tear), you’ll be obliged to replace them with newer versions that are “more economically useful and productive.” You will, by your own logic, be made richer.

Just send me a note with some times that are good for you for me to come by with some sledge hammers and blowtorches. Given the short distance between Fairfax and College Park, I can be at your place pronto. Oh, as an extra bonus, I promise not to clean up the mess! That way, there’ll be more jobs created for clean-up crews in your neighborhood."

The Story of Your Enslavement

If the government can help itself to as much of your property (and therefore time) as it pleases, does this means that you are a slave? Here’s a brief history explaining the rise of the modern system of mass enslavement:

The Grouch: I'm nowhere near as cynical as the creator of the this video, but I think it presents an interesting, though nightmarish, Orwellian point of view of human history and modern society. I don't think our overlords in the government exert the kind of control this video implies, though they are working hard to expand their reach. I still think freedom has the upper hand, and humans aren't livestock working for the benefits of their masters, but are working for the betterment of themselves and their families. What do you think?

The Grouch: I'm nowhere near as cynical as the creator of the this video, but I think it presents an interesting, though nightmarish, Orwellian point of view of human history and modern society. I don't think our overlords in the government exert the kind of control this video implies, though they are working hard to expand their reach. I still think freedom has the upper hand, and humans aren't livestock working for the benefits of their masters, but are working for the betterment of themselves and their families. What do you think?

Sunday, August 28, 2011

How to Lose Money While Making Money

Even the usually deaf, dumb and blind mainstream media is starting to realize there are ample opportunities to cut waste from government. This is just the tip of the iceberg.

Friday, August 26, 2011

Almost Everything You've Been Taught is Wrong: Defending the Indefensible

The co-authors of the new book The Declaration of Independents: How Libertarian Politics Can Fix What's Wrong with America (http://declaration2011.com), Nick Gillespie and David Boaz of the Cato Institute and Alex Tabarrok of George Mason University make the moral and economic case for often-vilified practices ranging from ticket scalping to human-organ sales to the creation of private currencies.

Thursday, August 25, 2011

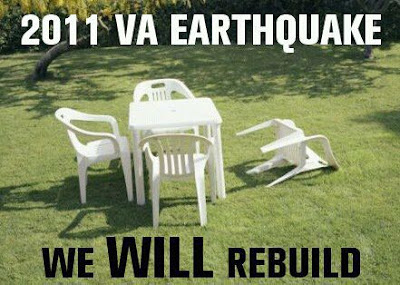

Lessons from the Great Quake

On Tuesday, as most of the country knows by now, the east coast of the US experienced a mild 5.9 earthquake. This was a very unusual occurrence. I've lived within 200 miles of Washington DC most of life and have not experienced anything like this before.

When the quake hit mid-afternoon, I was at work on the 7th floor of my office building. At first I thought a large truck had hit the building or an airplane was flying very close by because the windows and floor were shaking. When that shaking didn't stop after several seconds, I knew we were having an earthquake.

Some of my colleagues freaked out and headed for the exits as fast as possible, some even taking the elevator down to the lobby. Me, I stood my ground, and stupidly or wisely went back into my office and continued working until the facilities manager ran down the hallway telling everyone to get out of the building now. After walking down the backstairs, I joined the rest of the employees congregated around the building. Only later that night did it dawn on me we were all standing in the shadow of the very building that we just evacuated while the building inspectors were checking its structural soundness. Not very bright for a bunch of well-educated people since if the building had been damaged something could have fallen on us, or the whole building toppled over, but the herding instinct is strong. We should have been standing far away from the building in the middle of the parking lot, not on the sidewalk right outside the lobby.

This incident also pointed out the lack of a business continuity plan at work. If the building had been so damaged that we couldn't reenter, how would we have kept the business running? All our papers and computers were in this one building, with some data backups offsite, but nowhere to recover to. Not good.

The concept of business continuity should also apply to people and their financial lives. The earthquake (and the hurricane following close on its heels) serves as another reminder that John and Susie Homeowner need to protect themselves from disasters also. This starts with making sure the house is insured to cover today's full replacement value if you had to rebuild from the ground up. But it also covers wills and trust documents, important financial papers, tax returns, etc. A periodic backup or second copy of these should be stored in a safe place that can be easily accessed in the event of an emergency. Life goes on even after a natural disaster strikes, but most people don't think about this until it is too late.

When the quake hit mid-afternoon, I was at work on the 7th floor of my office building. At first I thought a large truck had hit the building or an airplane was flying very close by because the windows and floor were shaking. When that shaking didn't stop after several seconds, I knew we were having an earthquake.

Some of my colleagues freaked out and headed for the exits as fast as possible, some even taking the elevator down to the lobby. Me, I stood my ground, and stupidly or wisely went back into my office and continued working until the facilities manager ran down the hallway telling everyone to get out of the building now. After walking down the backstairs, I joined the rest of the employees congregated around the building. Only later that night did it dawn on me we were all standing in the shadow of the very building that we just evacuated while the building inspectors were checking its structural soundness. Not very bright for a bunch of well-educated people since if the building had been damaged something could have fallen on us, or the whole building toppled over, but the herding instinct is strong. We should have been standing far away from the building in the middle of the parking lot, not on the sidewalk right outside the lobby.

This incident also pointed out the lack of a business continuity plan at work. If the building had been so damaged that we couldn't reenter, how would we have kept the business running? All our papers and computers were in this one building, with some data backups offsite, but nowhere to recover to. Not good.

The concept of business continuity should also apply to people and their financial lives. The earthquake (and the hurricane following close on its heels) serves as another reminder that John and Susie Homeowner need to protect themselves from disasters also. This starts with making sure the house is insured to cover today's full replacement value if you had to rebuild from the ground up. But it also covers wills and trust documents, important financial papers, tax returns, etc. A periodic backup or second copy of these should be stored in a safe place that can be easily accessed in the event of an emergency. Life goes on even after a natural disaster strikes, but most people don't think about this until it is too late.

Wednesday, August 24, 2011

Paul Merriman: Fine Tuning Your Asset Class Allocation

A continuation of Paul Merriman's fine investment seminar that he was generous enough to post on the internet. Must viewing for serious, DIY investors.

Section 2, Part 1: Fine Tuning Your Asset Allocation

Section 2, Part 2: Fine Tuning Table

Section 2, Part 3: S&P 500 vs Worldwide Equity

Section 2, Part 4: The impact of adding fixed income

Section 2, Part 5: Fine Tuning for retirees and moderate risk investors

Section 2, Part 6: Finding your personal best asset allocation

Section 2, Part 1: Fine Tuning Your Asset Allocation

Section 2, Part 2: Fine Tuning Table

Section 2, Part 3: S&P 500 vs Worldwide Equity

Section 2, Part 4: The impact of adding fixed income

Section 2, Part 5: Fine Tuning for retirees and moderate risk investors

Section 2, Part 6: Finding your personal best asset allocation

Tuesday, August 23, 2011

The Revised 1040 Form

Good news for undertaxed millionaires and billionaires like Warren Buffett, Stephen King, and Jerry Springer. After all their whining in the press, the IRS has decided to revise 1040 form to make it easier for them to contribute a larger percentage of their income to the government than the current tax law requires. This should help close any perceived redistribution gaps that may be keeping them awake at night. My only objection to this section of the form is that the rates should allow choices higher than 100% so those suffering from tax-envy would be allowed to dip into their family wealth to support the common good.

The complete revised form also allows taxpayers to allocate the way money is spent. So those who don't believe in supporting National Defense or abortion or NPR, etc., with their hard earned tax dollars can specify where their money will be allocated. Does it get any better than this?

The complete revised form also allows taxpayers to allocate the way money is spent. So those who don't believe in supporting National Defense or abortion or NPR, etc., with their hard earned tax dollars can specify where their money will be allocated. Does it get any better than this?

via Zombie

Paul Merriman: Choosing the Best Asset Classes

Paul Merriman performs a great service for investors everywhere by posting his investment workshops online. This first section covering asset allocation closely mirrors Merriman's book Live It Up Without Outliving Your Money!: Getting the Most From Your Investments in Retirement.

Section 1, Part 1: How to get the most from your investments in retirement

Section 1, Part 2: Successful investing is 99.9% defense

Section 1, Part 3, The Ultimate Buy-and-Hold Strategy

Section 1, Part 4: Portfolio 1, Benchmarks

Section 1, Part 5: Portfolio 2, improving the bonds

Section 1, Part 6: Portfolio 3, adding REITs

Section 1, Part 7: Portfolio 4, adding Small Cap

Section 1, Part 8: Portfolio 5, adding Value

Section 1, Part 9: Portfolio 6, adding international stocks

Section 1, Part 1: How to get the most from your investments in retirement

Section 1, Part 2: Successful investing is 99.9% defense

Section 1, Part 3, The Ultimate Buy-and-Hold Strategy

Section 1, Part 4: Portfolio 1, Benchmarks

Section 1, Part 5: Portfolio 2, improving the bonds

Section 1, Part 6: Portfolio 3, adding REITs

Section 1, Part 7: Portfolio 4, adding Small Cap

Section 1, Part 8: Portfolio 5, adding Value

Section 1, Part 9: Portfolio 6, adding international stocks

Monday, August 22, 2011

Sunday, August 21, 2011

Robert Reich Does Comedy

Robert Reich, former Secretary of Labor under the Clinton Administration and lover of all government spending programs, explains the US Debt downgrade and the implications of further upgrades.

Friday, August 19, 2011

Thursday, August 18, 2011

Monday, August 15, 2011

Saturday, August 13, 2011

Happy Cost of Government Day: August 12

I was hoping to publish this post on Friday, but was too busy earning a living to get around to it.

This year the Cost of Government Day, the true American Independence Day, falls on August 12st. Americans had to labor a full 224 days into the year to pay for local, state and federal government spending and regulations, or slightly over 61% of the days in a year. Anyone else think this number is too high? Didn't we have a revolution against the British over a less oppressive system regulation, mercantilism and taxation than this one?

From the Americans for Tax Reform study: "Cost of Government Day (COGD) is the date of the calendar year on which the average American worker has earned enough gross income to pay off his or her share of the spending and regulatory burden imposed by government at the federal, state and local levels. Cost of Government Day for 2011 is today, August 12. On average, workers must toil 224 days out of the year just to meet all costs imposed by government. In other words, the cost of government consumes 61.42% of national income.

Cost of Government falls two days earlier than last year’s revised date of August 14 (see top chart above). In 2011, the average American will have to work an additional 41 days to pay off his or her share of the cost of government compared to ten years ago in 2001, when COGD was July 2. In fact, between 1977 and 2008, COGD had never fallen later than July 20. 2011 marks the third consecutive year COGD has fallen in August. The difference between 2008 and 2009—from July 16 to August 14—was a full 29 days. The increase was spurred by government intervention in the form of the Emergency Economic Stabilization Act (EESA) that created the Troubled Asset Relief Program (TARP) and the American Recovery and Reinvestment Act of 2009 (ARRA).

The two day decrease of the 2011 COGD is only a temporary fall before projections of increased future spending. In March 2010, President Obama signed the Patient Protection and Affordable Care Act (PPACA) into law which will add $2.3 trillion to COGD over its first decade. Even without counting Obamacare’s contributions to future COGDs, the three years of the Obama Administration have been three record-setting years of federal government regulation and spending—a 21.78 percent increase relative to the average size of the federal government between 1977 and 2008.

Cost of Government Day Components (see bottom chart):

1. The average American worker will have to labor 103 days this year just to pay for federal spending, which consumes 28.15% of net national product.

2. In 2011, the average American has to work 44.2 days to pay for state and local expenditures—roughly the same number of days in 2010 and one day less than the 45.4 days worked in 2009.

3. The average American must labor more than 77 days in 2011 just to cover the cost of government regulations (49.75 days for federal regulations and 27.6 days for state regulations) - identical to the number of days worked in 2010 and slightly less than the 79 days worked in 2009."

The full report can be found here.

This year the Cost of Government Day, the true American Independence Day, falls on August 12st. Americans had to labor a full 224 days into the year to pay for local, state and federal government spending and regulations, or slightly over 61% of the days in a year. Anyone else think this number is too high? Didn't we have a revolution against the British over a less oppressive system regulation, mercantilism and taxation than this one?

From the Americans for Tax Reform study: "Cost of Government Day (COGD) is the date of the calendar year on which the average American worker has earned enough gross income to pay off his or her share of the spending and regulatory burden imposed by government at the federal, state and local levels. Cost of Government Day for 2011 is today, August 12. On average, workers must toil 224 days out of the year just to meet all costs imposed by government. In other words, the cost of government consumes 61.42% of national income.

Cost of Government falls two days earlier than last year’s revised date of August 14 (see top chart above). In 2011, the average American will have to work an additional 41 days to pay off his or her share of the cost of government compared to ten years ago in 2001, when COGD was July 2. In fact, between 1977 and 2008, COGD had never fallen later than July 20. 2011 marks the third consecutive year COGD has fallen in August. The difference between 2008 and 2009—from July 16 to August 14—was a full 29 days. The increase was spurred by government intervention in the form of the Emergency Economic Stabilization Act (EESA) that created the Troubled Asset Relief Program (TARP) and the American Recovery and Reinvestment Act of 2009 (ARRA).

The two day decrease of the 2011 COGD is only a temporary fall before projections of increased future spending. In March 2010, President Obama signed the Patient Protection and Affordable Care Act (PPACA) into law which will add $2.3 trillion to COGD over its first decade. Even without counting Obamacare’s contributions to future COGDs, the three years of the Obama Administration have been three record-setting years of federal government regulation and spending—a 21.78 percent increase relative to the average size of the federal government between 1977 and 2008.

Cost of Government Day Components (see bottom chart):

1. The average American worker will have to labor 103 days this year just to pay for federal spending, which consumes 28.15% of net national product.

2. In 2011, the average American has to work 44.2 days to pay for state and local expenditures—roughly the same number of days in 2010 and one day less than the 45.4 days worked in 2009.

3. The average American must labor more than 77 days in 2011 just to cover the cost of government regulations (49.75 days for federal regulations and 27.6 days for state regulations) - identical to the number of days worked in 2010 and slightly less than the 79 days worked in 2009."

The full report can be found here.

Friday, August 12, 2011

Quote of the Day: Steven Horwitz

The bigger problem with the rhetoric of “giving back” is that it is shows a misunderstanding of the fundamental process by which wealth is generated. In particular it ignores the mutually beneficial nature of exchange and assumes that those who have become rich did so by “taking” from others. The only reason one would “give back” is that one has “taken” something inappropriately from others. The “back” in “give back” assumes that the thing in question rightfully belongs to someone else.

In a free market, of course, people don’t get rich by taking from others. They do so by providing goods and services that others wish to purchase because they value those things more highly than the money they are asked to pay. That is, the rich offer opportunities for mutually beneficial trades. This is why, as I noted last week, so many market transactions end with both parties saying “thank you.”

~ Steven Horwitz, from Giving Back

Thursday, August 11, 2011

Wednesday, August 10, 2011

Markets in Everything: Baseball Bat Sales Skyrocketing in the Land of Cricket

Baseball bats are suddenly the rage across Great Britain. Sales have soared all across the country. Law-abiding citizens are trying to arm themselves to protect their loved ones and property in this country that has outlawed handguns and other protections that Americans might take for granted. The citizens are arming themselves the only way they can legally.

Quote of the Day: Ludwig von Mises

Credit expansion cannot increase the supply of real goods. It merely brings about a rearrangement. It diverts capital investment away from the course prescribed by the state of economic wealth and market conditions. It causes production to pursue paths which it would not follow unless the economy were to acquire an increase in material goods. As a result, the upswing lacks a solid base. It is not real prosperity. It is illusory prosperity. It did not develop from an increase in economic wealth. Rather, it arose because the credit expansion created the illusion of such an increase. Sooner or later it must become apparent that this economic situation is built on sand.

~ Ludwig von Mises, Causes of the Economic Crisis, 1931

Tuesday, August 9, 2011

Quote of the Day: Mark Steyn

The fecklessness of Washington is an existential threat not only to the solvency of the republic but to the entire global order. If Ireland goes under, it’s lights out on Galway Bay. When America goes under, it drags the rest of the developed world down with it. When I go around the country saying stuff like this, a lot of folks agree. Somewhere or other, they’ve a vague memory of having seen a newspaper story accompanied by a Congressional Budget Office graph with the line disappearing off the top of the page and running up the wall and into the rafters circa mid-century. So they usually say, “Well, fortunately I won’t live to see it.” And I always reply that, unless you’re a centenarian with priority boarding for the ObamaCare death panel, you will live to see it. Forget about mid-century. We’ve got until mid-decade to turn this thing around.

Otherwise, by 2020 just the interest payments on the debt will be larger than the U.S. military budget. That’s not paying down the debt, but merely staying current on the servicing — like when you get your MasterCard statement and you can’t afford to pay off any of what you borrowed but you can just about cover the monthly interest charge. Except in this case the interest charge for U.S. taxpayers will be greater than the military budgets of China, Britain, France, Russia, Japan, Germany, Saudi Arabia, India, Italy, South Korea, Brazil, Canada, Australia, Spain, Turkey, and Israel combined.

When interest payments consume about 20 percent of federal revenues, that means a fifth of your taxes are entirely wasted. Pious celebrities often simper that they’d be willing to pay more in taxes for better government services. But a fifth of what you pay won’t be going to government services at all, unless by “government services” you mean the People’s Liberation Army of China, which will be entirely funded by U.S. taxpayers by about 2015. When the Visigoths laid siege to Rome in 408, the imperial Senate hastily bought off the barbarian king Alaric with 5,000 pounds of gold and 30,000 pounds of silver. But they didn’t budget for Roman taxpayers picking up the tab for the entire Visigoth military as a permanent feature of life.

And even those numbers pre-suppose interest rates will remain at their present historic low. Last week, the firm of Macroeconomic Advisors, one of the Obama administration’s favorite economic analysts, predicted that interest rates on ten-year U.S. Treasury notes would be just shy of nine percent by 2021. If that number is right, there are two possibilities: The Chinese will be able to quintuple the size of their armed forces and stick us with the tab. Or we’ll be living in a Mad Max theme park. I’d bet on the latter myself.

~ Mark Steyn, Mad Debt

Monday, August 8, 2011

Some Pundits on the S&P Downgrade

Jack Bogle

Jim Rogers (The look on Beers' face is priceless)

Ken Rogoff

Ken Langone

Wilber Ross

Jim Rogers (The look on Beers' face is priceless)

Ken Rogoff

Ken Langone

Wilber Ross

Sunday, August 7, 2011

Quote of the Day: Burton Malkiel

Is it time to sell all your stocks, which are still well above their lows of 2009? I think not. No one can predict what the stock market will do in this and coming weeks. Stocks may continue their decline, but I believe it would be a serious mistake for investors to panic and sell out. There are several reasons for optimism that in the long run we will see higher, not lower, market valuations.

First, I believe that stocks today are cheap. Price/earnings multiples are just over 14 and forward P/E multiples, which use forecasted earnings, have shrunk to less than 12. These multiples are low relative to historical precedent and are especially low when considered in comparison to a 10-year Treasury yield of 2.5%. Dividend yields of 2.5% also compare favorably with 10-year Treasurys. Multiples do not look cheap relative to average 10-year earnings (the so-called Shiller P/E multiples), but today's earnings are so much higher than average earnings that a 10-year average is not a good estimate of today's corporate-earning capacity.

Moreover, the structure of U.S. corporate earnings increasingly reflects economic activity abroad—including the rapidly growing emerging markets—rather than activity in the U.S. This is why corporate earnings have been growing so rapidly even though U.S. economic growth has been so tepid. For large U.S. multinational corporations, the continued growth in emerging markets will be the most important determinant of the future growth of corporate earnings. For many companies, what happens in China, India and Brazil is more important than the inability of Europe to get its house in order and the paralysis in the U.S. and Japan.

My advice for investors is to stay the course. No one has ever become rich by being a long-term bear on the fortunes of the United States, and I doubt that anyone will do so in the future. This is still the most flexible and innovative economy in the world. Indeed, it is in times like this that investors should consider rebalancing their portfolios. If increases in bond prices and declines in equities have produced an asset allocation that is heavier in fixed income than is appropriate, given your time horizon and tolerance for risk, then sell some bonds and buy stocks. Years from now you will be glad you did.

~ Burton Malkiel, Don't Panic About the Stock Market

Wake Up Call: The S&P Downgrade

Only the most naïve (like the Treasury secretary and numerous career politicians) should have been caught by surprise with S&Ps downgrade of US Goverment to AA+. The downgrade has been decades in the making, and politicians from both parties are to blame. Many are still in denial of the obvious-- the financial stability of the entitlement programs implemented by FDR and LBJ and expanded by numerous other Presidents and Congresses is unsustainable. The assumption behind their finances are there will always be at least 4 or more people working and paying into the programs than those collecting payouts (yes, early “investors” get paid with later “investors'” contributions). With families having fewer and fewer children, current demographics are throwing a monkey wrench into the implied government promise that workers paying into the system for somewhere between 30 – 45 years can enjoy a nice monthly government check as they live into their 80s and 90s. These programs need a major overhaul to reflect this new demographic reality. True to form, our politicians have not only failed to recognize the problem, but they have poured gasoline on the fire by enacting a massive new, unpopular entitlement called Obamacare whose financial problems could dwarf our current issues with Social Security. Medicare and Medicaid.

Anyone who thinks we don't have a spending problem in Washington just has to look at the past three years of blowout spending-- a trillion in spending added to the baseline:

Stunning. And all we have to show for it is this downgrade?

Below are the 18 countries considered better credit risks than the US:

France? We're a worse credit risk than France, that land of leisure and the epitome of the welfare state? Holy cow, I'm embarassed.

But what will be the real-world impact of this downgrade? Hopefully it will focus our political class on the problem and will distract them from doing more harm, and the pressure they feel will perhaps convince the Democrates that spending more money isn't the answer to every problem and cajole the Republicans into accepting some tax increases. But I'm not convinced this happen since I think the excessive partisanship is coming from top levels of the government. I expect the stock market to take in on the chin for at least another week. But I don't expect interest rates on government bonds to change much. I believe the biggest impact will be a wave of muni-bond downgrades, since most states and municipalities are dependent on payments from the federal government. If the feds are not AAA, how can they remain AAA? The states, municipalities and average Americans will take the brunt of this downgrade.

HT: Gateway Pundit

Anyone who thinks we don't have a spending problem in Washington just has to look at the past three years of blowout spending-- a trillion in spending added to the baseline:

Stunning. And all we have to show for it is this downgrade?

Below are the 18 countries considered better credit risks than the US:

France? We're a worse credit risk than France, that land of leisure and the epitome of the welfare state? Holy cow, I'm embarassed.

But what will be the real-world impact of this downgrade? Hopefully it will focus our political class on the problem and will distract them from doing more harm, and the pressure they feel will perhaps convince the Democrates that spending more money isn't the answer to every problem and cajole the Republicans into accepting some tax increases. But I'm not convinced this happen since I think the excessive partisanship is coming from top levels of the government. I expect the stock market to take in on the chin for at least another week. But I don't expect interest rates on government bonds to change much. I believe the biggest impact will be a wave of muni-bond downgrades, since most states and municipalities are dependent on payments from the federal government. If the feds are not AAA, how can they remain AAA? The states, municipalities and average Americans will take the brunt of this downgrade.

HT: Gateway Pundit

Rep. Paul Ryan, Bill Miller Talk Debt, Economy

Famous investor Bill Miller opines on the S&P debt downgrade and its impact on the markets.

Saturday, August 6, 2011

How to Build a Stink Bug Trap

They seem to be out in the Mid-Atlantic states in even greater numbers than last year.

Inspiring Economic Confidence

Former Obama economic adviser Christina Romer and Bill Maher got a chuckle out of the news yesterday that the US credit rating was downgraded for the first time in over a century.

Friday, August 5, 2011

The Question

After we just experience a stock market crash of over 500 points on a single day, and over 1300 points over the past 10 trading days, it's time to ask the question again:

Which option did you pick? This is somewhat of a trick question because the best answer depends on your age and whether you are in the accumulation or the dispersion phase of your financial life.

If you are a retiree, then you should pray for scenario A.

If you are just hitting your highest earning years, you should rejoice if scenario B occurs. You want stock prices to be low so you get more dividends and earnings for the dollars you invest. Be happy when corrections like this one present you the opportunity to accumulate more shares on the cheap.

Which scenario would you prefer?

A. Stocks go up and remain at elevated prices for a long period of time.

B. Stocks go down and stay down for a number of years.

Which option did you pick? This is somewhat of a trick question because the best answer depends on your age and whether you are in the accumulation or the dispersion phase of your financial life.

If you are a retiree, then you should pray for scenario A.

If you are just hitting your highest earning years, you should rejoice if scenario B occurs. You want stock prices to be low so you get more dividends and earnings for the dollars you invest. Be happy when corrections like this one present you the opportunity to accumulate more shares on the cheap.

Thursday, August 4, 2011

The Crisis in Confidence and the Decline of the US Economic Engine

I'm not much of an O'Reilly fan, but he comes pretty close to nailing here.

Quote of the Day: G. Warren Nutter

In the academic world, you think now and decide never; and in the government, it’s just exactly the other way around.

~ G. Warren Nutter

Sigmund Fraud: Are Tea Partiers 'Delusional' Addicts?

Taking journalism to new heights of ridiculousness, MSNBC host Martin Bashir interviewed Stanton Peele, a psychologist and an "expert on addiction," this afternoon, urging Peele to psychologically evaluate supporters of the Tea Party. "It reminds us of addiction because addicts are seeking something that they can't have," Peele said. "They want a state of happiness or nirvana that can't be achieved except through an artificial substance and reminds us of the Norway situation, when people are thwarted at obtaining something they can't, have they often strike out and Norway is one kind of example to one kind of reaction to that kind of a frustration."

Bashir later asked: "So you're saying that they are delusional about the past and adamant about the future?"

"They are adamant about achieving something that's unachievable, which reminds us of a couple of things. It reminds us of delusion and psychosis," Peele responded.

Grouch: So if I understand this line of reasoning correctly, people who want the government to spend less and be more fiscally responsible are addicts because their delusional state of nirvana is ignoble and can never be achieved, while those who want to keep the deficit spending going, even though we will soon be $15 trillion in debt and our debt load has already reached 100% of GDP, are non-addicts and sane individuals because their state of nirvana is noble even though it can never be achieved no matter how much of other people's money they spend.

I think Einstein summed up the situation quite well: "Insanity: doing the same thing over and over again and expecting different results." That is precisely where we are at with the spendaholic politicians in DC..... they keep doing the same old stupid things expecting different results and the taxpayer gets the bill for their delusional addictions. No wonder there is a growing body of people who are fed up with politics as usual.

Bashir later asked: "So you're saying that they are delusional about the past and adamant about the future?"

"They are adamant about achieving something that's unachievable, which reminds us of a couple of things. It reminds us of delusion and psychosis," Peele responded.

Visit msnbc.com for breaking news, world news, and news about the economy

Grouch: So if I understand this line of reasoning correctly, people who want the government to spend less and be more fiscally responsible are addicts because their delusional state of nirvana is ignoble and can never be achieved, while those who want to keep the deficit spending going, even though we will soon be $15 trillion in debt and our debt load has already reached 100% of GDP, are non-addicts and sane individuals because their state of nirvana is noble even though it can never be achieved no matter how much of other people's money they spend.

I think Einstein summed up the situation quite well: "Insanity: doing the same thing over and over again and expecting different results." That is precisely where we are at with the spendaholic politicians in DC..... they keep doing the same old stupid things expecting different results and the taxpayer gets the bill for their delusional addictions. No wonder there is a growing body of people who are fed up with politics as usual.

Red Tape Rising: The $1.75 Trillion Cost of US Regulation Is Twice the Amount of Individual Taxes Collected

A new report revealed this week that the annual cost of US regulation — $1.75 trillion — represents twice the amount of individual income taxes collected last year.

Heritage Foundation reported:

Heritage Foundation reported:

In the just-released “Red Tape Rising: A 2011 Mid-Year Report,” The Heritage Foundation’s James Gattuso and Diane Katz explain the pervasiveness of government’s intrusive regulatory hand (that oftentimes goes go well beyond ensuring product safety) and how it controls nearly every facet of your daily life.

Do you heat your home? Light your rooms? Buy and cook food? Watch TV? If the answer is “yes,” then you’ve fallen under federal regulation. And you’re paying for it, too. Gattuso and Katz explain how every product imaginable costs more because of regulations:

The costs of regulation are inevitably passed on to consumers in the form of higher prices and limited product choices. Basic items, such as toilets, showerheads, light bulbs, mattresses, washing machines, dryers, cars, ovens, refrigerators, television sets, and bicycles all cost significantly more because of government decrees on energy use, product labeling, and performance standards that go well beyond safety—as well as hundreds of millions of hours of testing and paperwork to document compliance.

The annual cost of regulation—$1.75 trillion by one frequently cited estimate—represents twice the amount of individual income taxes collected last year. Overall, from the beginning of the Obama Administration to mid-fiscal year (FY) 2011, regulators have imposed $38 billion in new costs on the American people, more than any comparable period on record. Consider Washington’s red tape to be a hidden tax.

The mountain of regulations didn’t begin under the Obama Administration. Under the Administration of George W. Bush, for example, $60 billion in additional annual regulatory costs were imposed on Americans. But as Katz and Gattuso write, the rate at which burdens are growing has accelerated under the Obama Administration.

Wednesday, August 3, 2011

Cartoon of the Day: The Original Extremists

The Declaration of Independence and the US Constitution are still the two most radical political documents ever written. They are so radical in their advocacy of personal freedom and individual responsibility that entire political movements have been created to subvert, distort and destroy their original intent so that the populace can once again be "subjects living off the benevolence of a King George III supersized government."

Quote of the Day: Frederic Bastiat

"Poor people! How much disillusionment is in store for them! It would have been so simple and so just to ease their burden by decreasing their taxes; they want to achieve this through the plentiful bounty of the state and they cannot see that the whole mechanism consists in taking away ten to give it back eight, not to mention the true freedom that will be destroyed in the operation!"

~ Frederic Bastiat, 1848

The Always Entertaining Marc Faber on Bear Markets, US Debt and Personal Responsibility

Some highlights:

"The Treasury market is telling you that the economy is in recession. So if the bond market is telling you that the economies of the Western world are weakening, but at the same time the stock market is still relatively high, I think the stock market is vulnerable."

"The politicians are all useless individuals. Nobody is reducing the problems in the US or Europe, just putting on a band aid and postponing the problems endlessly."

"Some analysts think that there's a chance economic data will surprise on the upside but I think, if anything, it will be on the downside."

"China disappointing is a much bigger risk for the global economy than the US because the US is no longer a major commodities buyer.... If commodity prices are falling, then commodity producers will buy fewer goods from China. This is something that the world central bankers can't deal with."

Tuesday, August 2, 2011

Quote of the Day: Warren Meyer

Having once been successful through excellence, leading businesses typically get lazy and senescent, and become vulnerable to more innovative, lower-cost or more nimble new competitors. Sears lost its electronics sales to Circuit City, which in turn succumbed to Best Buy, which is now struggling to compete with Wal-Mart, who is being challenged by Amazon.com.

Unfortunately, businesses that were once successful can feel a sense of entitlement, believing that this new competition is somehow unfair, or that consumers are somehow misguided in taking their business elsewhere. When they have money or political connections, these businesses may run to Congress and beg for special protections against competition, or even new subsidies, mandates, stimulus projects, and bailouts.

Where is the threat to capitalism and individual liberty coming from today? Is it from some aggrieved proletariat, or is the threat from bailed out Wall Street firms, and AIG, and GM, and Chrysler, and ethanol manufacturers, and electric car makers, and windmill builders?

~ Warren Meyer, from James Taggart is Alive and Well

Monday, August 1, 2011

The Talking Budget Apocalypse Satan Sandwich Blues

Now that it looks like the budget will get approved by both houses of Congress, let's catalogue for posterity (compiled from Twitter hashtag #ConsequencesofDefault) the apocalyptic predictions of what would happen if the government really shutdown:

Beltway policy experts begin living by own wits; after 45 minutes there are no survivors.

Roving bands of outlaws stalk our streets, selling incandescent bulbs to vulnerable children.

Unregulated mohair prices at the whim of unscrupulous mohair speculators.

NPR news segments no longer buffered by soothing zither interludes.

Breadlines teeming with jobless Outreach Coordinators, Diversity Liaisons, and Sustainability Facilitators.

Cowboy poetry utterly lacking in metre.

General Motors unfairly forced to build cars that people want, for a profit.

Chaos reigns at Goldman Sachs, who no longer knows who to bribe with political donations.

Mankind's dream of high speed government rail service between Chicago and Iowa City tragically dies.

Sesame Street descends into Mad Maxian anarchy; Oscar the Grouch fashions shivs out the letter J and the number 4

No longer protected by government warning labels, massive wave of amputations from people sticking limbs into lawn mowers

New York devolves into a dystopian hellscape of sugared cola moonshiners, salty snackhouses and tobacco dens.

At-risk Mexican drug lords forced to buy own machine guns.

Chevy Volt rebate checks bounce, stranded owners more than 50 miles from outlet.

WH communications office reduced to sending talking points to Media Matters via smoke signals and log drums.

Potential 5-year old terrorists head to boarding gates ungroped.

Defenseless mortgage holders forced to live in houses they can actually afford.

Without college loan program, America loses an entire generation of Marxist Dance Theorists.

Embarrassing state dinners, as Obamas are forced to downgrade from Wagyu to Kobe beef.

President Obama places tarp over Washington Monument to conceal from Chinese repo men.

With the Dept of Ed shuttered, national school quality plummets to 1960s levels.

Anthony Weiner is forced to pay for own sex addiction therapy.

Displaced teenaged policy wonks organize under Supreme Warlord Ezra Klein.

Nation's freeway exits croweded with desperate bureaucrats waving 'will regulate for food' signs.

State Department diplomacy becomes 38% less diplomatic.

WH holds rummage sale Rose Garden; all HOPE merchandise, styrofoam Greek columns 95% off.

At-risk Mexican drug lords forced to buy own machine guns.

Airline passengers forced to pat-down their own genitals before boarding their flights.

With funding cut, research scientists may never know what a howler monkey’s favorite song is.

Huge spike in mattress label removal as populace goes haywire.

Cowboys must fund their own poetry

Some children left behind, where they belong.

We may never know how much toenail nicotine is present vs saliva swabbing (yes, *this* is actual gubmint study!)

We may never find out if rats on cocaine will abandon their babies.

Dept. of Education cancels programs considered to be non-essential such as Reading, Writing, & Arithmetic.

Next state visit to Britain all PM gets is a "Bowery Boys" movie collection on VHS.

Michelle Obama's vacations limited to watching the Travel Channel.

Nation's freeway exits filled with desperate bureaucrats waving 'will regulate for food' signs.

Government ceases doing some of the things it doesn’t have the constitutional power to do.

Beltway policy experts begin living by own wits; after 45 minutes there are no survivors.

Roving bands of outlaws stalk our streets, selling incandescent bulbs to vulnerable children.

Unregulated mohair prices at the whim of unscrupulous mohair speculators.

NPR news segments no longer buffered by soothing zither interludes.

Breadlines teeming with jobless Outreach Coordinators, Diversity Liaisons, and Sustainability Facilitators.

Cowboy poetry utterly lacking in metre.

General Motors unfairly forced to build cars that people want, for a profit.

Chaos reigns at Goldman Sachs, who no longer knows who to bribe with political donations.

Mankind's dream of high speed government rail service between Chicago and Iowa City tragically dies.

Sesame Street descends into Mad Maxian anarchy; Oscar the Grouch fashions shivs out the letter J and the number 4

No longer protected by government warning labels, massive wave of amputations from people sticking limbs into lawn mowers

New York devolves into a dystopian hellscape of sugared cola moonshiners, salty snackhouses and tobacco dens.

At-risk Mexican drug lords forced to buy own machine guns.

Chevy Volt rebate checks bounce, stranded owners more than 50 miles from outlet.

WH communications office reduced to sending talking points to Media Matters via smoke signals and log drums.

Potential 5-year old terrorists head to boarding gates ungroped.

Defenseless mortgage holders forced to live in houses they can actually afford.

Without college loan program, America loses an entire generation of Marxist Dance Theorists.

Embarrassing state dinners, as Obamas are forced to downgrade from Wagyu to Kobe beef.

President Obama places tarp over Washington Monument to conceal from Chinese repo men.

With the Dept of Ed shuttered, national school quality plummets to 1960s levels.

Anthony Weiner is forced to pay for own sex addiction therapy.

Displaced teenaged policy wonks organize under Supreme Warlord Ezra Klein.

Nation's freeway exits croweded with desperate bureaucrats waving 'will regulate for food' signs.

State Department diplomacy becomes 38% less diplomatic.

WH holds rummage sale Rose Garden; all HOPE merchandise, styrofoam Greek columns 95% off.

At-risk Mexican drug lords forced to buy own machine guns.

Airline passengers forced to pat-down their own genitals before boarding their flights.

With funding cut, research scientists may never know what a howler monkey’s favorite song is.

Huge spike in mattress label removal as populace goes haywire.

Cowboys must fund their own poetry

Some children left behind, where they belong.

We may never know how much toenail nicotine is present vs saliva swabbing (yes, *this* is actual gubmint study!)

We may never find out if rats on cocaine will abandon their babies.

Dept. of Education cancels programs considered to be non-essential such as Reading, Writing, & Arithmetic.

Next state visit to Britain all PM gets is a "Bowery Boys" movie collection on VHS.

Michelle Obama's vacations limited to watching the Travel Channel.

Nation's freeway exits filled with desperate bureaucrats waving 'will regulate for food' signs.

Government ceases doing some of the things it doesn’t have the constitutional power to do.

Why I Love Crises and 100+ Point Down Days on the Dow

One of the secrets to being a successful investor is you must invest when times look bleakest and hold your cash when everyone is euphoric. Emotionally, this is very hard to do. The natural reaction of most people is to run for the exits when the market starts heading down and to buy after a large run-up in prices when everyone in the office is standing around the water cooler lying about how much money they just made in the markets. But you must resist this instinct to be one of the herd, unless you are satisfied with less than average returns.

By nature, I'm a long-term, buy-and-hold passive investor. I don't time the markets and try to get out at the highs and in at the lows. I don't have the skill to do that. But I do, however, try to use my investable cash wisely, which means I may sit on it for a while when I think the markets are frothy and wait for a pullback. Crises, such as the current debt ceiling debate, present one of those opportunities. All the angst and hysteria in the news media over financial Armageddon have caused a sell off. On Friday, I was putting a chunk of my cash to work at what looked to be a bleak moment in this crisis. If the current budget compromise goes down in flames, I'll be back nibbling at equities again.

Always keep in mind that the cheaper the asset price the higher your potential returns. Long-term investors should take great pleasure in these temporary pull-backs and use these golden opportunities to fulfill their goals of investing for retirement, a new house, etc. Emotions are the worst enemy of the investor. If you can discipline yourself to take the opposite action of what your emotions tell you to do, you'll be a much more successful investor.

By nature, I'm a long-term, buy-and-hold passive investor. I don't time the markets and try to get out at the highs and in at the lows. I don't have the skill to do that. But I do, however, try to use my investable cash wisely, which means I may sit on it for a while when I think the markets are frothy and wait for a pullback. Crises, such as the current debt ceiling debate, present one of those opportunities. All the angst and hysteria in the news media over financial Armageddon have caused a sell off. On Friday, I was putting a chunk of my cash to work at what looked to be a bleak moment in this crisis. If the current budget compromise goes down in flames, I'll be back nibbling at equities again.

Always keep in mind that the cheaper the asset price the higher your potential returns. Long-term investors should take great pleasure in these temporary pull-backs and use these golden opportunities to fulfill their goals of investing for retirement, a new house, etc. Emotions are the worst enemy of the investor. If you can discipline yourself to take the opposite action of what your emotions tell you to do, you'll be a much more successful investor.

Quote of the Day: Milton Friedman

When “fairness” replaces “freedom,” all our liberties are in danger. In Walden, Thoreau says: “If I knew for a certainty that a man was coming to my house with the conscious design of doing me good, I should run for my life.” That is the way I feel when I hear my “servants” in Washington assuring me of the “fairness” of their edicts.

~ Milton Friedman

Subscribe to:

Posts (Atom)