For the investor, tax efficient investing is more important now than ever since the big hand of government is preparing to dig deeper into everyone's wallet. On the income side, it is vitally important to max out 401k and IRA contribution (if tax deductible), minimize capital gains distributions through index investing, and tax manage the income portion of the portfolio so that taxable bonds are held in retirement accounts and tax-free bonds are held in regular accounts. If a VAT becomes law (and the tax and spenders are drooling over the prospect because it is hard for the average person to see and understand this tax), everyone should expect an across the board increase in the costs of all goods. There are few options to avoid this type of tax except through reduced consumption.

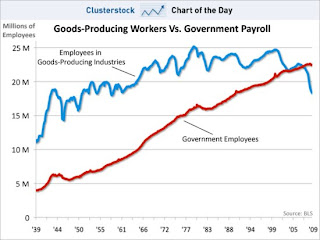

People should keep some things in mind when evaluating the wisdom of all this proposed tax and spending. A few pictures are worth a thousand words:

It's not the revenues. It's the spending, stupid. We live in the age of government greed where the federal Leviathan keeps growing faster than the economy and individual incomes, where federal worker salaries and benefits far outstrip that of the private sector and their numbers just keep growing. The Leviathan needs to be starved, not fed, if there is any hope of preserving the American dream for generations to come. Otherwise, we are just stealing from the future to pay for the foolishness of today.

I'm not sure we can go back. The libraries have video collections that rival Netflix. The local community centers and high schools have workout facilities that rival the commercial companies. Teachers get pensions of 2% of salary for each year taught and the pensions aren't funded! Now Social Security even has to be funded from additional taxes - no more surplus.

ReplyDeleteIt's up to the voters!

We shall see come November, let's hope this time around the Republicans have learned something about what America needs....not necessarily wants.

ReplyDelete