Friday, April 30, 2010

Charlie Munger on Wall Street Scandals

Never one to mince words. You know he is going to defend BRKs investment in GS.

Fast Food

Thursday, April 29, 2010

Laptop Reliability

Anyone in the market for a new laptop should take into consideration reliability in addition to other subjective ergonomic factors. I'm a bit surprised to see HP and Gateway trailing the pack. I know Asus makes a solid machine, and have had my share of issues with Dell PC's I used both at work and at home, a number of wacky motherboard problems.

This study published by warranty-provider SquareTrade tracks the failure rates for over 30,000 laptops covered by their warranties. Some highlights of the study:

This study published by warranty-provider SquareTrade tracks the failure rates for over 30,000 laptops covered by their warranties. Some highlights of the study:

- Looking at the first 3 years of ownership, 31% of laptop owners reported a failure to SquareTrade. Two-thirds of this failure (20.4%) came from hardware malfunctions, and one-third (10.6%) was reported as accidental damage.

- Netbooks are projected to have a 20% higher failure rate from hardware malfunctions than more expensive laptop computers.

- ASUS and Toshiba were the most reliable manufacturers, with fewer than 16% having a hardware malfunction over 3 years.

Comcast Wins Worst Company in America Award

The votes are in, and Comcast has won Consumerist's uncoveted "Worst Company in America" award.

The Philadelphia telecom firm beat runner-up Ticketmaster in the last round of voting by a margin of 59 to 41 percent -- ending a two-year losing streak that saw it crushed by AIG in 2009 and run over by Countrywide Home Loans in 2008.

Grouch: The vote must have taken place prior to the Goldman hearings.

The Philadelphia telecom firm beat runner-up Ticketmaster in the last round of voting by a margin of 59 to 41 percent -- ending a two-year losing streak that saw it crushed by AIG in 2009 and run over by Countrywide Home Loans in 2008.

Grouch: The vote must have taken place prior to the Goldman hearings.

Brad Pailsey: American Saturday Night

As close to a pro-free trade, pro-immigration, pro-melting pot country song as you'll hear:

She’s got Brazilian leather boots on the pedal of her German car

Listen to the Beatles singing Back in the USSR

Yeah, she’s goin’ around the world tonight

But she ain’t leavin here

She’s just going to meet her boyfriend down at the street fair

It’s a French kiss, Italian ice

Spanish moss in the moonlight

Just another American Saturday night

There’s a big toga party tonight down at Delta Chi

They’ve got Canadian bacon on their pizza pie

They’ve got a cooler full of cold Coronas and Amstel light

It’s like were all livin’ in a big ol’ cup

Just fire up the blender, mix it all up

It’s a French kiss, Italian ice

Margaritas in the moonlight

Just another American Saturday night

You know, everywhere has something they’re known for

Although usually it washes up on our shores

My great great great granddaddy stepped off of that ship

I bet he never ever dreamed we’d have all this

You know everywhere has somethin’ they’re known for

Although usually it washes up on our shores

Little Italy, Chinatown, sittin’ there side by side

Live from New York, It’s Saturday Night!

It’s a French kiss, Italian ice,

Spanish moss in the moonlight

Just another American, just another American,

It’s just another American Saturday night

HT: Cafe Hayek

Wednesday, April 28, 2010

The Milken Institute: Energy Security

| Total Imports of Petroleum (Top 15 Countries) (Thousand Barrels per Day) | |||||

|---|---|---|---|---|---|

| Country | Jan-10 | Dec-09 | YTD 2010 | Jan-09 | YTD 2009 |

| CANADA | 2,593 | 2,649 | 2,593 | 2,544 | 2,544 |

| MEXICO | 1,131 | 1,204 | 1,131 | 1,430 | 1,430 |

| NIGERIA | 1,013 | 1,029 | 1,013 | 509 | 509 |

| SAUDI ARABIA | 963 | 893 | 963 | 1,362 | 1,362 |

| VENEZUELA | 911 | 849 | 911 | 1,353 | 1,353 |

| IRAQ | 506 | 325 | 506 | 568 | 568 |

| ALGERIA | 498 | 544 | 498 | 720 | 720 |

| RUSSIA | 463 | 385 | 463 | 516 | 516 |

| BRAZIL | 353 | 184 | 353 | 450 | 450 |

| COLOMBIA | 322 | 231 | 322 | 269 | 269 |

| VIRGIN ISLANDS | 308 | 289 | 308 | 367 | 367 |

| UNITED KINGDOM | 282 | 199 | 282 | 147 | 147 |

| ANGOLA | 280 | 278 | 280 | 543 | 543 |

| ECUADOR | 215 | 86 | 215 | 278 | 278 |

| NORWAY | 126 | 65 | 126 | 90 | 90 |

Note: The data in the tables above exclude oil imports into the U.S. territories.

HT: http://paul.kedrosky.com

HT: http://paul.kedrosky.com

Gambling with Other People's Money

Russ Roberts, a professor at George Mason University, has written an essay on the financial crisis entitled Gambling with Other People’s Money: How Perverted Incentives Created the Financial Crisis that is well worth the read and pertinent to today's debate on financial reform. A pdf version is available also.

A short excerpt from the essay outlines the premise:

HT: Cafe Hayek

A short excerpt from the essay outlines the premise:

Over the last three decades, government policy has coddled creditors, reducing the risk they face from financing bad investments. Not surprisingly, this encouraged risky investments financed by borrowed money. The increasing use of debt mixed with housing policy, monetary policy, and tax policy crippled the housing market and the financial sector. Wall Street is not blameless in this debacle. It lobbied for the policy decisions that created the mess.The author summarizes his argument as follows:

In the United States we like to believe we are a capitalist society based on individual responsibility. But we are what we do. Not what we say we are. Not what we wish to be. But what we do. And what we do in the United States is make it easy to gamble with other people’s money—particularly borrowed money—by making sure that almost everybody who makes bad loans gets his money back anyway. The financial crisis of 2008 was a natural result of these perverse incentives. We must return to the natural incentives of profit and loss if we want to prevent future crises.

1. It isn't "too big to fail" that's the problem, it's the rescue of creditors going back to 1984, encouraged imprudent lending and allowed large financial institutions to become highly leveraged.

2. Shareholder losses do not reduce the problem even when shareholders are the executives making the decisions

3. These incentives allowed execs to justify and fund enormous bonuses until they blew up their firms. Whether they planned on that or not doesn't matter. The incentives remain as long as creditors get bailed out.

4. Changes in regulations encouraged risk-taking by artificially encouraging the attractiveness of AAA-rated securities.

5. Changes in US housing policy helped inflate the housing bubble, particularly the expansion of Fannie and Freddie into low downpayment loans.

6. The increased demand for housing resulting from Fanne and Freddie's expansion pushed up the price of housing and helped make subprime attractive to banks. But the ultimate driver of destruction was leverage. Either lenders were irrationally exuberant or were lulled into that exuberance by the persistent rescues of the previous three decades.

HT: Cafe Hayek

Who Wants to Beat a Millionaire?

| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c | |||

| Who Wants to Beat a Millionaire | ||||

| www.thedailyshow.com | ||||

| ||||

Quote of the Day: Richard Epstein -- The Goldman Gaffe

In the end, we learn a lot from this latest SEC fiasco. The agency that cannot detect a Madoff fraud can conjure up a Goldman fraud out of thin air. At this point, some fundamental reform is in order. Forget the fancy stuff. Either the SEC should master its primary fraud prevention mission, or it should shut down altogether.HT: Cafe Hayek

~Richard Epstein in Forbes

Bove, Krauthammer & Bubba on Goldman Sachs

Dick Bove

Charles Krauthammer

Bubba (surprisingly insightful)

Hopefully few people wasted their time watching the Senate hearings yesterday on Goldman Sachs. I wasted an hour yesterday watching Lloyd Blankfein answer questions. Little productive came out of these hearings other than the Senators demonstrating their ignorance on the financial markets and Goldman doing their best to avoid addressing the concerns. Both sides looked bad. The hearings only served to increase my fear that those attempting to regulate the financial markets don't understand the financial markets and are likely to do more harm than good. This doesn't mean we should leave the status quo in place. But we need less demagoguery and a smaller, more carefully thought out bill than the 1,400 page plus monstrosity that is in committee now. The Fannie and Freddie problem needs to be addressed sooner rather than later, and quite frankly is a more serious issue and poses more danger to the taxpayer than this Goldman circus.

Charles Krauthammer

Bubba (surprisingly insightful)

Hopefully few people wasted their time watching the Senate hearings yesterday on Goldman Sachs. I wasted an hour yesterday watching Lloyd Blankfein answer questions. Little productive came out of these hearings other than the Senators demonstrating their ignorance on the financial markets and Goldman doing their best to avoid addressing the concerns. Both sides looked bad. The hearings only served to increase my fear that those attempting to regulate the financial markets don't understand the financial markets and are likely to do more harm than good. This doesn't mean we should leave the status quo in place. But we need less demagoguery and a smaller, more carefully thought out bill than the 1,400 page plus monstrosity that is in committee now. The Fannie and Freddie problem needs to be addressed sooner rather than later, and quite frankly is a more serious issue and poses more danger to the taxpayer than this Goldman circus.

Tuesday, April 27, 2010

Open Courses at Yale

Follow this link to an ECON 252: Financial Markets (Spring, 2008) class taught by Robert Schiller.

The general course page can be found at: http://oyc.yale.edu/.

The general course page can be found at: http://oyc.yale.edu/.

Quote of the Day: David Brooks

The premise of the current financial regulatory reform is that the establishment missed the last bubble and, therefore, more power should be vested in the establishment to foresee and prevent the next one.HT: http://gregmankiw.blogspot.com/

~ David Brooks

Ackman Defends the Shorts

Bill Ackman, managing partner of Pershing Square Capital Management, discusses the benefits of short-selling and the Goldman Sachs' fraud charges.

Simon Lorne, chief legal officer for hedge fund Millennium Management and former general counsel at the SEC, discusses how strong the SEC's case is against Goldman Sachs.

Monday, April 26, 2010

Oakmark: Growing with the Times

Investors may remember the Oakmark funds from the recent Supreme Court cases over different fees for the same fund for different types of clients. Others might remember them from William Bernstein's book The Four Pillars of Investing, where he cited Robert Sanborn's initial overperformance as head of the Oakmark Fund to his subsequent underperformance and firing while he stuck with value stocks like Philip Morris and Mattel as the market went gaga over dotcom. However, I'm not here to bad-mouth the Oakmark funds. Outside of indexes, I own some small positions in several actively managed funds, including a couple of the Oakmark funds. Over the long term their funds have performed reasonably well, garnering accolades for many of their managers such as Morningstar Manager of the Year and Decade. However, a couple of things stand out in their marketing literature. Fund expenses of over 1% for most funds sets a pretty high bar the managers have to overcome to match market performance. Investor return after taxes and expenses is not published, which is the vital statistic in my opinion. Return since inception is meaningful for those who bought at the beginning and held on, but how many people is that? Almost none, since funds don't get noticed until they put up performance numbers. Average investor return would be more reflective of investor experience. I'm all for disclosure and transparency. While this marketing literature is not as bad as many fund families, it could be made better with a few small additions.

SNL: 2010 Public Employee of the Year Award

This isn't particularly funny, in fact it's a pretty bad skit, I'm just surprised they'd actually air it, though there's a grain of truth to it.

Sunday, April 25, 2010

Markets in Everything: Virtual Goods

Social media site Facebook currently has over 400 million users. Many of these Facebook users play a game called Farmville by Zynga Software. Personally, I think Farmville and Facebook, for that matter, are gigantic wastes of times, except when it comes to tracking down and getting in touch with old friends. So I spend little to no time on these sites. But Farmville seems to be one of those games that is addictive for many Facebook users. Farms require constant attention and other farmers often gift things to their friends, which, of course, must be reciprocated in kind. Farmville thrives off of peer pressure and competition in the virtual world. Where Zynga Software makes their money is by selling the gamers of Farmville accessories for their farm such as windmills, farm animals and equipment. Who in their right mind would pay real money for bits and bites in the virtual world of Farmville you might ask? Evidently a lot of people. Zynga Software had revenues in the area of $450 million this past year. Not bad for selling make-believe stuff.

Sunday Verse: Dorianne Laux -- The Shipfitter's Wife

The Shipfitter's Wife

I loved him mostwhen he came home from work,

his fingers still curled from fitting pipe,

his denim shirt ringed with sweat

and smelling of salt, the drying weeds

of the ocean. I would go to him where he sat

on the edge of the bed, his forehead

anointed with grease, his cracked hands

jammed between his thighs, and unlace

the steel-toed boots, stroke his ankles,

his calves, the pads and bones of his feet.

Then I'd open his clothes and take

the whole day inside me-- the ship's

gray sides, the miles of copper pipe,

the voice of the foreman clanging

off the hull's silver ribs, spark of lead

kissing metal, the clamp, the winch,

the white fire of the torch, the whistle

and the long drive home.

~Dorianne Laux

Saturday, April 24, 2010

Quote of the Day: Warren Buffett

We believe that according the name 'investors' to institutions that trade actively is like calling someone who repeatedly engages in one-night stands a 'romantic.'Quote chosen in honor of our illustrious Wall Street investment banks who are about to get some comeuppance.

~ Warren Buffett

What a Shocker: Obamacare to Cost Significantly More than Estimated

Even my grandfather with his third grade country schoolhouse education could have predicted this, but it takes a Harvard educated lawyer to delude themselves that this kind of entitlement will be budget neutral. I further predict it will cost even more than these actuaries estimate. Hence, the need for VAT and Cap and Trade taxes to feed this beast.

Thursday, April 22, 2010

Trying Goldman Sachs in the Court of Public Opinion

I'm not ok with bad jokes.

I'm not ok with stupid, inaccurate analogies and faulty reporting either.

I'm not ok with cheerleading.

Anyone else remember all that taxpayer money Eliot Spitzer wasted?

But I am ok with well-reasoned commentary.

With each day that goes by and each new revelation, the SEC case against Goldman Sachs looks weaker and weaker. I don't think the endgame here has ever been to convict GS in federal court, but to try them in the court of public opinion, to capitalize on the anti-Wall Street sentiment within the media and main street, to push through a financial reform package that, quite frankly, doesn't hurt Wall Street very much, decreases competition, and increases the politicization of financial regulation. The tacit is working. Disinformation is flying around all over the internet and media outlets. They are guilty before the judge even enters the chamber. I'm shedding no tears over it. For years Goldman has profited mightily from the political connections, both Republican and Democrat, contributing close to $1M to the Obama campaign, numerous CEO visits to the White House, and alumni placed in key positions in the administration.

Full disclosure: I hold no positions in investment banks.

I'm not ok with stupid, inaccurate analogies and faulty reporting either.

I'm not ok with cheerleading.

Anyone else remember all that taxpayer money Eliot Spitzer wasted?

But I am ok with well-reasoned commentary.

With each day that goes by and each new revelation, the SEC case against Goldman Sachs looks weaker and weaker. I don't think the endgame here has ever been to convict GS in federal court, but to try them in the court of public opinion, to capitalize on the anti-Wall Street sentiment within the media and main street, to push through a financial reform package that, quite frankly, doesn't hurt Wall Street very much, decreases competition, and increases the politicization of financial regulation. The tacit is working. Disinformation is flying around all over the internet and media outlets. They are guilty before the judge even enters the chamber. I'm shedding no tears over it. For years Goldman has profited mightily from the political connections, both Republican and Democrat, contributing close to $1M to the Obama campaign, numerous CEO visits to the White House, and alumni placed in key positions in the administration.

Full disclosure: I hold no positions in investment banks.

Paulson & Co. turns Bullish on Housing, Economy

Marketwatch - As the SEC complaint against Goldman Sachs seems to be slowly unraveling, we now learn from yesterday's conference call that John Paulson, who famously shorted the housing market in 2007 and 2008 to the tune of billions in profits, now sees little chance for a double dip recession. In fact, he envisions a strong V-shaped recovery, a "vibrant" credit market, with housing prices stabilized and poised for an 8-10% run-up in 2011. Only time will tell whether he's right or not, but he's putting his money where his mouth is and has covered many of his short positions. It was also disclosed that Paulson is the largest investor in the SPDR Gold Trust ETF (GLD), with the expectation that inflation is coming due to the quantitative easing of the US Government which has increased the monetary base by 150% since the start of the financial crisis.

Sunday, April 18, 2010

Sunday Verse: John Clare (1793-1864) -- "I am!"

I am!

I am! yet what I am none cares or knows,

My friends forsake me like a memory lost;

I am the self-consumer of my woes,

They rise and vanish in oblivious host,

Like shades in love and death's oblivion lost;

And yet I am! and live with shadows tost

Into the nothingness of scorn and noise,

Into the living sea of waking dreams,

Where there is neither sense of life nor joys,

But the vast shipwreck of my life's esteems;

And e'en the dearest--that I loved the best--

Are strange--nay, rather stranger than the rest.

I long for scenes where man has never trod;

A place where woman never smil'd or wept;

There to abide with my creator, God,

And sleep as I in childhood sweetly slept:

Untroubling and untroubled where I lie;

The grass below--above the vaulted sky.

I am! yet what I am none cares or knows,

My friends forsake me like a memory lost;

I am the self-consumer of my woes,

They rise and vanish in oblivious host,

Like shades in love and death's oblivion lost;

And yet I am! and live with shadows tost

Into the nothingness of scorn and noise,

Into the living sea of waking dreams,

Where there is neither sense of life nor joys,

But the vast shipwreck of my life's esteems;

And e'en the dearest--that I loved the best--

Are strange--nay, rather stranger than the rest.

I long for scenes where man has never trod;

A place where woman never smil'd or wept;

There to abide with my creator, God,

And sleep as I in childhood sweetly slept:

Untroubling and untroubled where I lie;

The grass below--above the vaulted sky.

Saturday, April 17, 2010

The Curious Timing of the SEC's Goldman Sachs Fraud Complaint

Cramer's Take on Goldman Sachs

30036962-Abacus-2007-Ac1-Flipbook-20070226

SEC complaint against Goldman Sachs

Did anyone else find the timing of this accusation against Goldman Sachs particularly interesting? On a day when the SEC admitted that it knew about the Allen Stanford Ponzi scheme as early as 1997 but did not act because the case was not a quick hitter slam dunk, the headlines now shift to Goldman Sachs and "financial reform" legislation. Would government officials be calculating enough to do such a thing to put public pressure behind the "financial reform" bill? You betcha.

So what is Goldman accused of? Colluding with John Paulson and ACA Management to build an investment vehicle of mortgages most likely to fail, apply a credit rating those bundled mortgages and sell them to unsuspecting institutional buyers while Paulson sold those instruments short, betting sub-prime loans would default in large numbers. Well, not exactly. They are accusing of "making materially misleading statements and omission in connection with a synthetic collateralized debt obligation GS&Co structured and marketed to investors." Specifically, they misrepresented that ACA selected the portfolio instead of Paulson, and failed to disclose Paulson was intending to short the security. I find it interesting that all three parties aren't charged with a criminal act for colluding to defraud investors of the $1B that Paulson made on the transaction. But the real purpose is to shake the public's faith in Wall Street again, add to their perceptions that Wall Street is a rigged game that favors certain power brokers at the expense of others, and whip-up public sentiment against Wall Street so the financial reform bill will pass.

I have no idea if the government prosecution of Goldman Sachs will be successful. I do believe GS and the other Wall Street firms are riddled with ethical challenges and conflicts of interest. They will sell anybody anything they are willing to buy. I also believe in caveat emptor. I expect this action by the government will generate many more lawsuits from investors who lost money on these types of transactions, as well as additional government law suites against other Wall Street firms.

For the individual investor, these actions will likely trigger a downturn in the markets, and present an opportunity to pick-up equities at cheaper prices. Don't get scared off. Take advantage of the cheaper prices.

30036962-Abacus-2007-Ac1-Flipbook-20070226

SEC complaint against Goldman Sachs

Did anyone else find the timing of this accusation against Goldman Sachs particularly interesting? On a day when the SEC admitted that it knew about the Allen Stanford Ponzi scheme as early as 1997 but did not act because the case was not a quick hitter slam dunk, the headlines now shift to Goldman Sachs and "financial reform" legislation. Would government officials be calculating enough to do such a thing to put public pressure behind the "financial reform" bill? You betcha.

So what is Goldman accused of? Colluding with John Paulson and ACA Management to build an investment vehicle of mortgages most likely to fail, apply a credit rating those bundled mortgages and sell them to unsuspecting institutional buyers while Paulson sold those instruments short, betting sub-prime loans would default in large numbers. Well, not exactly. They are accusing of "making materially misleading statements and omission in connection with a synthetic collateralized debt obligation GS&Co structured and marketed to investors." Specifically, they misrepresented that ACA selected the portfolio instead of Paulson, and failed to disclose Paulson was intending to short the security. I find it interesting that all three parties aren't charged with a criminal act for colluding to defraud investors of the $1B that Paulson made on the transaction. But the real purpose is to shake the public's faith in Wall Street again, add to their perceptions that Wall Street is a rigged game that favors certain power brokers at the expense of others, and whip-up public sentiment against Wall Street so the financial reform bill will pass.

I have no idea if the government prosecution of Goldman Sachs will be successful. I do believe GS and the other Wall Street firms are riddled with ethical challenges and conflicts of interest. They will sell anybody anything they are willing to buy. I also believe in caveat emptor. I expect this action by the government will generate many more lawsuits from investors who lost money on these types of transactions, as well as additional government law suites against other Wall Street firms.

For the individual investor, these actions will likely trigger a downturn in the markets, and present an opportunity to pick-up equities at cheaper prices. Don't get scared off. Take advantage of the cheaper prices.

Thursday, April 15, 2010

US Recovery 'Engineered Wrongly', Bubbles Forming

So warns David Roche, global strategist at Independent Strategy Ltd. No less a financial giant than George Soros stated at a recent meeting hosted by The Economist: "Unless we learn the lessons, that markets are inherently unstable and that stability needs to be the objective of public policy, we are facing a yet larger bubble. We have added to the leverage by replacing private credit with sovereign credit and increasing national debt by a significant amount." Unlike these gentlemen, I do not have much faith in the government's ability to engineer a recovery. All governments seem to know how to do is throw money in the general direction of problem, hope and pray things get better, and then declare victory when the market heals itself as they pile up a lot of debt. However, I do agree with Roche if we want to encourage saving instead of debt-funded consumption interest rates must be raised. I would prefer to see interest rate head up sooner rather than later in the US. But there is little political will to anything other than spend, spend, spend, when the exact opposite is needed.

Tuesday, April 13, 2010

WaMu...... A Tale of Two Banks.... And One Investor

First, viewing the world through rose-colored glasses:

Next, taking the rose-colored glasses off:

I've read a number of articles on financial blogs lately touting the virtues of investing in in corporate DRIP programs. While I have no argument with dividend oriented investing, and certainly not with reinvesting dividends, I do have a problem with the notion the road to wealth for Joe Investor is through DRIPs. The sales-pitch for DRIPs typically runs along the lines of buy a dividend achiever type of blue chip stock with an above market yield, compound the interest and grow rich over the years as the dividends and earnings grow. Tales abound of investors who bought Coke, IBM, or Proctor & Gamble 40 years ago, reinvested dividends to astonishing returns. No one talks about the companies who performed poorly or went out of business. The small-time DRIP investor almost by definition will be a concentrated investor, with typically no more than 15-20 holdings tops. So what happens to that type of investor if they are unlucky and end up sinking a large percentage of their wealth into the DRIP of a dividend achiever like WaMu? What happens if they pick the wrong 15-20 stocks? Is the risk worth it?

No less an investor than famed value guru Bill Nygren of the concentrated Oakmark Select fund had as much as 17-18% of that fund invested in WaMu during the company's go-go days. Nygren has compiled an impressive record running his fund, but how could he have been so badly fooled? In the chart below, the blue line indicates how Oakmark Select fund performed compared to its peers (orange line) and the market as whole (green line).

Nygren was able to exit his large position in WaMu before the company imploded when he saw it was in trouble and limit the damage to his shareholders. I doubt Joe Investor would be that nimble, especially not in a DRIP which requires a substantial commitment to the long-term viability of a company. The moral of the story is very simple: why should Joe investor take on the risk of concentrating their investments in a small number of companies when they can own the entire stock market, eliminate individual company risk, reinvest the dividends and participate in economic growth of the country or the world for pennies on the dollar? For every one Apple Computer, there are Enrons, WorldComs, WaMus, Kodaks, Polaroids, Fannie Mae, Freddie Mac, Merrill Lynch, Lehman Brothers, Bear Stearns, AIG, Ambac, MBIA... the list goes on and on. As fast as the world is changing today, how many people are skilled enough to pick a small number of individual stocks that will still be thriving 30-40 years from now? Even the bluest of blue chips like AT&T is struggling with the technological obsolescence of its copper wire phone network. Will they be in business 30-40 years from now, or another casualty of the creative destruction of capitalism? Who knows, but why take the chance?

Next, taking the rose-colored glasses off:

I've read a number of articles on financial blogs lately touting the virtues of investing in in corporate DRIP programs. While I have no argument with dividend oriented investing, and certainly not with reinvesting dividends, I do have a problem with the notion the road to wealth for Joe Investor is through DRIPs. The sales-pitch for DRIPs typically runs along the lines of buy a dividend achiever type of blue chip stock with an above market yield, compound the interest and grow rich over the years as the dividends and earnings grow. Tales abound of investors who bought Coke, IBM, or Proctor & Gamble 40 years ago, reinvested dividends to astonishing returns. No one talks about the companies who performed poorly or went out of business. The small-time DRIP investor almost by definition will be a concentrated investor, with typically no more than 15-20 holdings tops. So what happens to that type of investor if they are unlucky and end up sinking a large percentage of their wealth into the DRIP of a dividend achiever like WaMu? What happens if they pick the wrong 15-20 stocks? Is the risk worth it?

No less an investor than famed value guru Bill Nygren of the concentrated Oakmark Select fund had as much as 17-18% of that fund invested in WaMu during the company's go-go days. Nygren has compiled an impressive record running his fund, but how could he have been so badly fooled? In the chart below, the blue line indicates how Oakmark Select fund performed compared to its peers (orange line) and the market as whole (green line).

Nygren was able to exit his large position in WaMu before the company imploded when he saw it was in trouble and limit the damage to his shareholders. I doubt Joe Investor would be that nimble, especially not in a DRIP which requires a substantial commitment to the long-term viability of a company. The moral of the story is very simple: why should Joe investor take on the risk of concentrating their investments in a small number of companies when they can own the entire stock market, eliminate individual company risk, reinvest the dividends and participate in economic growth of the country or the world for pennies on the dollar? For every one Apple Computer, there are Enrons, WorldComs, WaMus, Kodaks, Polaroids, Fannie Mae, Freddie Mac, Merrill Lynch, Lehman Brothers, Bear Stearns, AIG, Ambac, MBIA... the list goes on and on. As fast as the world is changing today, how many people are skilled enough to pick a small number of individual stocks that will still be thriving 30-40 years from now? Even the bluest of blue chips like AT&T is struggling with the technological obsolescence of its copper wire phone network. Will they be in business 30-40 years from now, or another casualty of the creative destruction of capitalism? Who knows, but why take the chance?

What the US Tax Code Really Costs

How much does it cost to just comply with the United States Tax Code? $338 Billion (more than $1000 per American citizen), not to mention the immense cost in time---the IRS itself estimates that Americans spend 7.6 billion hours a year dealing with the complexities.

I don't think anyone who's filled out a tax return lately would argue that the tax code is too simple or that they'd like to spend more time and money preparing their tax return. I don't hold much hope that there are any politicians in Washington who know how to make things simpler. Every time tax simplification legislation gets passed, the tax code just keeps getting larger and larger, and more and more complex. For grins, I've posted the original 1913 tax forms (that dreaded year that kicked off this lunacy) for the readers to compare to the contortions they have to go through today. Notice the tax rates: 0% on $1 - $19,999, 1% on $20,000 - $49,999, 2% on $50,000 - $74,999, 3% on $75,000 - $99,999, 4% on $100,000 - $249,999, 5% on $250,000 - $499,999, and 6% over $500,000. That looks a lot more like The Land of Opportunity than what I see today.

I don't think anyone who's filled out a tax return lately would argue that the tax code is too simple or that they'd like to spend more time and money preparing their tax return. I don't hold much hope that there are any politicians in Washington who know how to make things simpler. Every time tax simplification legislation gets passed, the tax code just keeps getting larger and larger, and more and more complex. For grins, I've posted the original 1913 tax forms (that dreaded year that kicked off this lunacy) for the readers to compare to the contortions they have to go through today. Notice the tax rates: 0% on $1 - $19,999, 1% on $20,000 - $49,999, 2% on $50,000 - $74,999, 3% on $75,000 - $99,999, 4% on $100,000 - $249,999, 5% on $250,000 - $499,999, and 6% over $500,000. That looks a lot more like The Land of Opportunity than what I see today.

Monday, April 12, 2010

The Growth of Walmart

PIIGS - World Sovereign Debt Visualized

One thing I seem to constantly harp on in this blog is excessive government debt, its evils, and the harm it does the citizens of those countries and the eventual impact on their standard of living and currencies. Click to enlarge the above chart and get a geographic representation of world debt levels. The worst countries at living beyond their means are marked in red. The debt PIIGS---Portugal, Italy, Ireland, Greece, and Spain---teeter on the brink of crisis, with others not far behind. Unsustainable levels of government spending on social welfare are a problem in much of the world that few politicians have the guts to solve.

Uh-oh, The Newsweek Cover Contrarian Indicator

Newsweek covers are infamous as contrarian investment indicators. These people have a real knack for reading public sentiment and predicting future economic direction exactly wrong. Whenever they proclaim things like the death of equities, it's time to mortgage the farm and plow your life savings into stocks. Hopefully, this self congratulatory cover is not a contrary harbinger of what it to come.

Sunday, April 11, 2010

Sunday Verse: Bluebird

Bluebird

there's a bluebird in my heart that

wants to get out

but I'm too tough for him,

I say, stay in there, I'm not going

to let anybody see

you.

there's a bluebird in my heart that

wants to get out

but I pour whiskey on him and inhale

cigarette smoke

and the whores and the bartenders

and the grocery clerks

never know that

he's

in there.

there's a bluebird in my heart that

wants to get out

but I'm too tough for him,

I say,

stay down, do you want to mess

me up?

you want to screw up the

works?

you want to blow my book sales in

Europe?

there's a bluebird in my heart that

wants to get out

but I'm too clever, I only let him out

at night sometimes

when everybody's asleep.

I say, I know that you're there,

so don't be

sad.

then I put him back,

but he's singing a little

in there, I haven't quite let him

die

and we sleep together like

that

with our

secret pact

and it's nice enough to

make a man

weep, but I don't

weep, do

you?

~ Charles Bukowski

there's a bluebird in my heart that

wants to get out

but I'm too tough for him,

I say, stay in there, I'm not going

to let anybody see

you.

there's a bluebird in my heart that

wants to get out

but I pour whiskey on him and inhale

cigarette smoke

and the whores and the bartenders

and the grocery clerks

never know that

he's

in there.

there's a bluebird in my heart that

wants to get out

but I'm too tough for him,

I say,

stay down, do you want to mess

me up?

you want to screw up the

works?

you want to blow my book sales in

Europe?

there's a bluebird in my heart that

wants to get out

but I'm too clever, I only let him out

at night sometimes

when everybody's asleep.

I say, I know that you're there,

so don't be

sad.

then I put him back,

but he's singing a little

in there, I haven't quite let him

die

and we sleep together like

that

with our

secret pact

and it's nice enough to

make a man

weep, but I don't

weep, do

you?

~ Charles Bukowski

Saturday, April 10, 2010

William J. Bernstein, author of The Investor's Manifesto

Introduction to The Investor's Manifesto (excellent book!)

William J. Bernstein is one of my favorite investment authors. I periodically re-read his books The Intelligent Asset Allocator, The Four Pillars of Investing, and The Investor's Manifesto. I encourage everyone to listen to this video and read one of his books, whether you purchase it or check it out from the library.

Wine Making -- Illustrated

The Conception of Wine - Infographic from Tiago Cabaco on Vimeo.

Wine making explained at a conceptual level. Of course, the joker in me wants to ask when is the carbon tax coming for wine makers, and for that matter when it is coming for anyone who's still breathing.

Friday, April 9, 2010

John Stossel -- What is a Libertarian?

Part 1

Part 2

Part 3

Part 4

Part 5

Are you a Libertarian? Test your Libertarian purity at http://www.bcaplan.com/cgi-bin/purity.cgi

Wednesday, April 7, 2010

VAT: A Bad Idea Whose Time Has Inevitably Come?

Daniel Mitchell, of the CATO Institute, and Shawn Tully, editor at large at Fortune magazine, discuss whether a value-added-tax would be a good solution to solve the country's deficit problem. These guys get right to the point. My own take is that the overspending problem in Washington is not strictly an Obama phenomenon, though he has done nothing but pour gasoline on a fire that has been building for years. Having two of the most fiscally irresponsible Presidents in the history of the country back to back does not bode well for our future. There is no financial discipline in Washington today and neither party has the political fortitude to cut even a dime of spending, much less implement the kind of dramatic reductions throughout government that are required to restore the barest semblance of responsible stewardship. Something as simple as an overall spending freeze from this year to the next would be a welcome change in direction. But the political discussion over the budget barely even mentions the spending side of the equation. That is what is most troubling to me. Just as the private sector must adjust to economic conditions, the government needs to downsize, reduce benefits, eliminate the unnecessary (and there is a lot of unnecessary) for the good of its citizens. It needs to stop trying to play sugar daddy with other people's money. To paraphrase Thatcher: "The problem with socialism is that eventually you run out of other people's money to spend."

New Battle May Erupt Over High Retirement Fund Fees

I've read numerous articles and opinion pieces over the past week lamenting the Supreme Court's failure to rule in favor of the investor on excessive mutual fund fees and discrepancies in fees between different share classes. Most story leads read as follows: "The Supreme Court handed a victory to the $11 trillion mutual fund industry by endorsing a 1982 legal standard to decide the fairness of fund fees, a ruling that gives companies considerable freedom to set investment adviser charges." Speculation abounds that a rash of new law suits challenging the status quo will be filed.

My take is very simple. Investors should take action and vote with their feet. Refuse to buy funds with high fees. And if you're currently in high-fee funds move your money to low-fee alternatives. Don't look to Washington for answers. Empower yourself. The marketplace works.

My take is very simple. Investors should take action and vote with their feet. Refuse to buy funds with high fees. And if you're currently in high-fee funds move your money to low-fee alternatives. Don't look to Washington for answers. Empower yourself. The marketplace works.

Here it Comes: Volcker Floats the Idea of Increased Taxes and a VAT

Our current set of politicians seem to be hellbent on dragging the country down the road to European-style socialism. Instead of enrolling in a 12-step program to cure their compulsive spending habits with other people's money, they sent out Paul Volcker yesterday to begin floating the trial balloons and laying the groundwork for higher taxes. Of course, these ideas will be sold as the only way to close the massive federal deficits caused by overspending, and the naive may fall for it. But any observer of political behavior knows the politicians will spend every dime of revenue that comes in plus whatever they think the public will tolerate above that. Let me repeat: any observer of political behavior knows the politicians will spend every dime of revenue the government receives plus whatever they think the public will tolerate above that. Don't be tricked into falling for the ruse that increased taxes are necessary to reduce the deficit. Increased taxes are necessary to support a permanent increased level of government spending, and that is the real objective. Make no mistake about the intention. The bully state is in ascendancy at the moment. Forced cradle to grave nannyism is the order of the day.

For the investor, tax efficient investing is more important now than ever since the big hand of government is preparing to dig deeper into everyone's wallet. On the income side, it is vitally important to max out 401k and IRA contribution (if tax deductible), minimize capital gains distributions through index investing, and tax manage the income portion of the portfolio so that taxable bonds are held in retirement accounts and tax-free bonds are held in regular accounts. If a VAT becomes law (and the tax and spenders are drooling over the prospect because it is hard for the average person to see and understand this tax), everyone should expect an across the board increase in the costs of all goods. There are few options to avoid this type of tax except through reduced consumption.

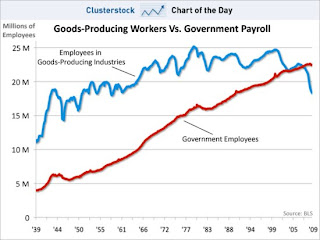

People should keep some things in mind when evaluating the wisdom of all this proposed tax and spending. A few pictures are worth a thousand words:

It's not the revenues. It's the spending, stupid. We live in the age of government greed where the federal Leviathan keeps growing faster than the economy and individual incomes, where federal worker salaries and benefits far outstrip that of the private sector and their numbers just keep growing. The Leviathan needs to be starved, not fed, if there is any hope of preserving the American dream for generations to come. Otherwise, we are just stealing from the future to pay for the foolishness of today.

For the investor, tax efficient investing is more important now than ever since the big hand of government is preparing to dig deeper into everyone's wallet. On the income side, it is vitally important to max out 401k and IRA contribution (if tax deductible), minimize capital gains distributions through index investing, and tax manage the income portion of the portfolio so that taxable bonds are held in retirement accounts and tax-free bonds are held in regular accounts. If a VAT becomes law (and the tax and spenders are drooling over the prospect because it is hard for the average person to see and understand this tax), everyone should expect an across the board increase in the costs of all goods. There are few options to avoid this type of tax except through reduced consumption.

People should keep some things in mind when evaluating the wisdom of all this proposed tax and spending. A few pictures are worth a thousand words:

It's not the revenues. It's the spending, stupid. We live in the age of government greed where the federal Leviathan keeps growing faster than the economy and individual incomes, where federal worker salaries and benefits far outstrip that of the private sector and their numbers just keep growing. The Leviathan needs to be starved, not fed, if there is any hope of preserving the American dream for generations to come. Otherwise, we are just stealing from the future to pay for the foolishness of today.

Sunday, April 4, 2010

Wealthtrack with Charles Ellis and Jason Zweig

For some reason this video takes a while to load, so please be patient. Two investment legends, Charles Ellis and Jason Zwieg, discuss the 2008 financial meltdown, and the lessons they learned:

- The unthinkable can and will happen.

- In times of crisis, risk assets like stocks and bonds go down excessively, but don't panic, they also recover excessively.

- A constant cushion of cash is a must for every portfolio.

- Every portfolio needs a core of protection, assets that are negatively correlated to the stock market, that will zig with other things zag, such as cash, gold, and U.S. Treasury Securities.

Sunday Verse: The Second Coming

The Second Coming

Turning and turning in the widening gyre

The falcon cannot hear the falconer;

Things fall apart; the centre cannot hold;

Mere anarchy is loosed upon the world,

The blood-dimmed tide is loosed, and everywhere

The ceremony of innocence is drowned;

The best lack all conviction, while the worst

Are full of passionate intensity.

Surely some revelation is at hand;

Surely the Second Coming is at hand.

The Second Coming! Hardly are those words out

When a vast image out of Spiritus Mundi

Troubles my sight: somewhere in sands of the desert

A shape with lion body and the head of a man,

A gaze blank and pitiless as the sun,

Is moving its slow thighs, while all about it

Reel shadows of the indignant desert birds.

The darkness drops again; but now I know

That twenty centuries of stony sleep

Were vexed to nightmare by a rocking cradle,

And what rough beast, its hour come round at last,

Slouches towards Bethlehem to be born?

~ William Butler Yeats

Turning and turning in the widening gyre

The falcon cannot hear the falconer;

Things fall apart; the centre cannot hold;

Mere anarchy is loosed upon the world,

The blood-dimmed tide is loosed, and everywhere

The ceremony of innocence is drowned;

The best lack all conviction, while the worst

Are full of passionate intensity.

Surely some revelation is at hand;

Surely the Second Coming is at hand.

The Second Coming! Hardly are those words out

When a vast image out of Spiritus Mundi

Troubles my sight: somewhere in sands of the desert

A shape with lion body and the head of a man,

A gaze blank and pitiless as the sun,

Is moving its slow thighs, while all about it

Reel shadows of the indignant desert birds.

The darkness drops again; but now I know

That twenty centuries of stony sleep

Were vexed to nightmare by a rocking cradle,

And what rough beast, its hour come round at last,

Slouches towards Bethlehem to be born?

~ William Butler Yeats

Friday, April 2, 2010

1st Quarter Returns 2010

| Fund Name | Symbol | Allocation | Return |

| Vanguard Total Stock Market ETF | VTI | 6.75% | 6.04% |

| Vanguard Value ETF | VTV | 6.75% | 6.22% |

| Vanguard Small-Cap ETF | VB | 6.75% | 9.67% |

| Vanguard Small-Cap Value ETF | VBR | 6.75% | 10.22% |

| Vanguard REIT ETF | VNQ | 3.00% | 10.10% |

| Vanguard Total Vanguard FTSE All-World ETF | VEU | 5.40% | 1.79% |

| iShares MSCI EAFE Value ETF | EFV | 5.40% | -0.36% |

| Vanguard FTSE All-World ex-US Small Cap ETF | VSS | 5.40% | 4.50% |

| WisdomTree International Small Cap Dividend ETF | DLS | 5.40% | 3.82% |

| Vanguard Emerging Markets ETF | VWO | 5.40% | 2.49% |

| iShares S&P Dev ex-US Property ETF | WPS | 3.00% | 0.48% |

| ---- | |||

| Vanguard Total Bond Market ETF | BND | 20.00% | 1.70% |

| iShares S&P National AMT-Free Municipal Bond ETF | MUB | 5.00% | 1.17% |

| SPDR Barclays Capital High Yield Bond ETF | JNK | 5.00% | 3.71% |

| iShares S&P U.S. Preferred Stock Index ETF | PFF | 5.00% | 6.61% |

| iShares JPMorgan USD Emerging Markets Bond ETF | EMB | 5.00% | 4.05% |

| ----- | |||

| Quarterly Portfolio Return | 4.26% |

The sample balanced passive portfolio (60% stocks, 40% income) returned a healthy 4.26% for the quarter with no dependence on star managers, and much lower fees than the average mutual fund, and low turnover. All performance figures were taken from Morningstar.

Thursday, April 1, 2010

Burden of Paying for Health Care Will Fall on the Middle Class

Renown Washington, D.C. financial planner and author, Ric Edelman, postulates that the tax burden for the health care will fall on the middle class. His message: Obamacare will make life harder for the middle class. I agree with him. How could it be otherwise? They are the cash cow that pays for every brain fart Congress dreams up.

For an even more explicit and lengthy accounting of all the taxes and fees, this past weekend's radio show can be found at http://ricedelman.com/cs/radio_show/past_shows?id=673.

We are in deep do-do.

Computers Just Keep Getting Cheaper and Better

I

Subscribe to:

Comments (Atom)