Sunday, July 31, 2011

Judge Judy vs. the Welfare State

Is this why we need "to eat our peas" and buy into "shared sacrifice?"

Happy 99th Birthday, Milton Friedman!

There’s no way to appreciate fully the contributions of Nobel Prize-winning economist Milton Friedman (1912-2006), who would have turned 99 years old this weekend, to the growth of libertarian ideas and a free society.

This is the man, after all, who introduced the concept of school vouchers, documented the role of government monopolies on money in creating inflation, provided the intellectual arguments that ended the military draft in America, co-founded the Mont Pelerin Society, and so much more. In popular books such as Capitalism and Freedom and Free to Choose, written with his wife and longtime collaborator Rose, he masterfully drew a through-line between economic freedom and political and cultural freedom.

Yet his ultimate contribution to freedom and liberty is found less in any of the specific argument he made and more in the ways he made them. Friedman provided an all-too-rare example of a public intellectual who was scrupulously honest, forthright, and fair in every debate he entered. Whether he was duking it out with fellow Nobel Prize winners and other high-profile economists or making the case for the morality of capitalism with TV hosts such as Phil Donahue and angry students, he always argued in good faith, admitted when he was wrong, and enlarged the circle of debate.

Long after some of his technical points and social insights have been superseded, that commitment to relentless inquiry and search for truth wherever it takes us will survive.

Milton Friedman gave us something much better than revealed truth: He showed us the process by which we might continue to indefinitely learn about our world and the human condition. In this sense, the Friedman Century is far from over; indeed, it’s just getting started.

Friday, July 29, 2011

Quote of the Day: John Hussman

Still, it’s precisely that short average maturity that makes the debt problematic from a long-run perspective, because it can’t be inflated away easily. In the event of sustained inflation, the debt would have to be constantly refinanced at higher and higher yields. Contrary to the assertion that the U.S. can easily inflate its debts away, it is clear that sustained inflation would create enormous risks to our long-run fiscal condition by driving interest costs to an intolerable share of revenues. At that point, any shortfall in GDP growth or government revenues would result in a rapid spike in debt-to-GDP (as Greece and other peripheral European nations are experiencing now). Prior to embarking on an inflationary course, the first thing a government would want to do is dramatically lengthen the maturity of its debts.

~ John Hussman

Does Apple Really Have More Cash On Hand Than the US Government?

Apple cannot print money and doesn't collect taxes. It just sells products that customers want to buy. But according to the latest daily statement from the U.S. Treasury, Apple has a higher operating cash balance than the US Treasury. The government had $73.8 billion at the end of the day yesterday, while Apple's latest earning report indicated the company had $76.2 billion in cash and marketable securities at the end of June. In other words, the world's largest tech company has more cash than the world's largest sovereign government. The reason is simple: Apple is extremely careful about how it spends its cash, while the government...... well, you fill in the answer.

Quote of the Day: H. L. Mencken

"The whole aim of practical politics is to keep the populace alarmed (and hence clamorous to be led to safety) by menacing it with an endless series of hobgoblins, all of them imaginary."

~ H. L. Mencken

Thursday, July 28, 2011

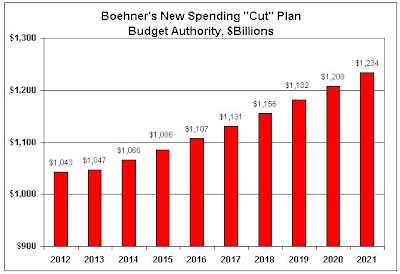

Anyone See the Discretionary Spending Cuts in the Boehner Plan?

Didn't think so.

House Speaker John Boehner has revised his budget plan in response to an unfavorable analysis by the CBO. The CBO has examined Boehner’s new plan and finds that it would cut spending by $917 billion over 10 years. Of the total, only $761 billion would be cuts to programs. The rest of the savings would be from reduced interest costs.

Actually, the revised Boehner plan doesn’t cut spending at all. The chart shows the discretionary spending caps in the new Boehner plan. Spending increases every year—from $1.043 trillion in 2012 to $1,234 trillion in 2021. (These figures exclude the costs of wars in Iraq and Afghanistan).

The “cuts” in the Boehner plan are only cuts from the CBO baseline, which is an assumed path of constantly rising spending. If Congress wanted to, it could require CBO to increase its “baseline” spending by, say, $5 trillion over the next decade. Then Boehner could claim that he was “cutting” spending by $5.9 trillion, even though his plan hadn’t changed. You can see that discretionary “cuts” against baselines don’t mean anything.

The way to make real spending cuts is to abolish programs and agencies. Members need to step up to the plate and tell us where they would cut the budget. The reality of ongoing $1 trillion deficits is that Congress has to start abolishing programs, privatizing activities, and making other lasting reforms. Promising to reduce spending growth a bit from projected baseline increases won’t do the job.

The same analysis applies to the Reid Plan, or any other plan that will come out of Washington to address the debt crisis.

Wednesday, July 27, 2011

An Interview with S&P's Global Head of Sovereign Ratings

While most of the talk among politicians and pundits has centered around whether the US will default on its debt if the debt ceiling isn't lifted, I've always believe after our 10 year spending binge that the real threat was that the US debt would be downgraded by the rating agencies. While an increase in interest rates would benefit savers, it will punish debtors like the US very heavily.

Last night, Larry Kudlow spoke with David Beers, head of S&P's sovereign debt rating committee. Beers made it very clear: the U.S. must take steps to lower its debt/GDP trend over the long run. He is looking at all the plans, and he is waiting for a final product. But right now a U.S. downgrade is 50-50. S&P's next step could come very soon.

Over the next couple of weeks, it will be interesting to see if the ratings agencies will have the nerve to make a gusty call. With the passage of the Dodd-Frank Financial Reform act they are no longer completely independent entities, but are now regulated by the very government they must pass judgement on. From the Senate documentation summarizing the bill:

CREDIT RATING AGENCIES

Establishes a new Office of Credit Rating Agencies at the Securities and Exchange Commission to strengthen regulation of credit rating agencies. New rules for internal controls, independence, transparency and penalties for poor performance will address shortcomings and restore investor confidence in these ratings.

Why Change Is Needed: Rating agencies market themselves as providers of independent research and in-depth credit analysis. But in this crisis, instead of helping people better understand risk, they failed to warn people about risks hidden throughout layers of complex structures.

Flawed methodology, weak oversight by regulators, conflicts of interest, and a total lack of transparency contributed to a system in which AAA ratings were awarded to complex, unsafe asset-backed securities - adding to the housing bubble and magnifying the financial shock caused when the bubble burst. When investors no longer trusted these ratings during the credit crunch, they pulled back from lending money to municipalities and other borrowers.

New Requirements and Oversight of Credit Rating Agencies

- New Office, New Focus at SEC: Creates an Office of Credit Ratings at the SEC with its own compliance staff and the authority to fine agencies. The SEC is required to examine Nationally Recognized Statistical Ratings Organizations at least once a year and make key findings public.

- Disclosure: Requires Nationally Recognized Statistical Ratings Organizations to disclose their methodologies, their use of third parties for due diligence efforts, and their ratings track record.

- Independent Information: Requires agencies to consider information in their ratings that comes to their attention from a source other than the organizations being rated if they find it credible.

- Conflicts of Interest: Prohibits compliance officers from working on ratings, methodologies, or sales.

- Liability: Investors could bring private rights of action against ratings agencies for a knowing or reckless failure to conduct a reasonable investigation of the facts or to obtain analysis from an independent source.

- Right to Deregister: Gives the SEC the authority to deregister an agency for providing bad ratings over time.

- Education: Requires ratings analysts to pass qualifying exams and have continuing education.

- Reduce Reliance on Ratings: Requires the GAO study and requires regulators to remove unnecessary references to NRSRO ratings in regulations.

Tuesday, July 26, 2011

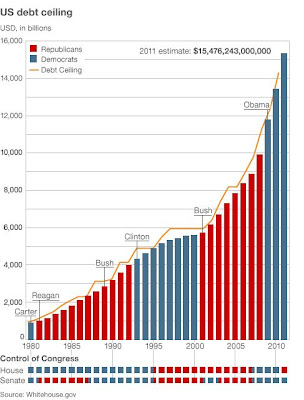

How Effective Has the Debt-Ceiling Been in Putting a Ceiling on the Growth of Debt?

The obvious answer is not very effective. In fact, the pace of debt accumulation debt has picked up substantially in the past 10 years. Where is the shame and remorse on the part of Congressmen and Presidents who play this con game (tax increases up front and spending cuts that never materialize) with the American people? What about some shared sacrifice where government takes the hit and feels the pain? It certainly wasn't on display in last night's speeches.

Thomas Sowell writes today about this game of "debt-ceiling chicken":

"The national debt-ceiling law should be judged by what it actually does, not by how good an idea it seems to be. The one thing that the national debt-ceiling has never done is to put a ceiling on the rising national debt. Time and time again, for years on end, the national debt-ceiling has been raised whenever the national debt gets near whatever the current ceiling might be (see chart above, courtesy of today's "The Gartman Letter").

Regardless of what it is supposed to do, what the national debt-ceiling actually does is enable any administration to get all the political benefits of runaway spending for the benefit of their favorite constituencies -- and then invite the opposition party to share the blame, by either raising the national debt ceiling, or by voting for unpopular cutbacks in spending or increases in taxes.

The Obama administration is a classic example. When all its skyrocketing spending bills were being rushed through Congress without even being read, the Democrats had such overwhelming majorities in both the Senate and the House of Representatives that Republicans had all they could do to get a word in edgewise -- even though their words had no chance of stopping, or even slowing down, the spending of trillions of dollars.

Now that the bill is coming due for all that spending and borrowing, Republicans are suddenly being invited in to share the blame for either raising the national debt ceiling or for whatever other unpopular measures will be legislated.

Many years ago, someone said, "If you didn't invite me to the big take-off, don't invite me to the crash landing." This was Obama's big spending spree, but "bipartisanship" requires Republicans to either split the bill or be blamed if the government shuts down or defaults.

What would happen if there were no national debt-ceiling law?

Those who got the political benefits from handing out trillions of dollars of the taxpayers' money (plus borrowed money) would also get the clear and sole blame for the resulting skyrocketing national debt and all the unpopular consequences."

Looks Yummy

I'm famished after listening to Obama and Boehner's hyper-partisan political speeches last night. So let's see what's on the menu at the Congressional Cafe....

Monday, July 25, 2011

Quote of the Day: Dwight D. Eisenhower

You and I, and our government must avoid the impulse to live only for today, plundering, for our own ease and convenience, the precious resources of tomorrow.

~ Dwight D. Eisenhower, 1961

Monday, July 18, 2011

Cars = Freedom. The Only Frank Lloyd Wright Designed Gas Station

The only Frank Lloyd Wright designed gas station ever to be built was constructed in Cloquet Minnesota. Located on the edge of an expansive wilderness area, this small lumber town prizes its architectural gem.

Part 1

Part 2

Part 1

Part 2

UAW TARP Beneficiaries on Lunch Break

Chrysler Auto Workers in Trenton Caught Smoking and Drinking During Lunch Breaks

The taxpayers of the US and the bondholders of GM and Chrysler sacrificed to ensure the auto companies were saved from the inevitable cuts and downsizing that would have resulted from bankruptcy. It is doubtful whether the taxpayers will ever get their money back in full from this deal. This video speaks volumes about the problems that continue to plague the American automakers.

Based on my own car buying experience, I'd do a very subjective quality rating as follows:

- Honda

- Toyota

- Mazda

- Ford

- Chrysler

- GM

Sunday, July 17, 2011

Friday, July 15, 2011

Is Vanguard the Mutual Fund Industry's Greatest Enabler of Excessive Executive Pay?

In a new study that cannot please Vanguard founder, Jack Bogle, the American Federation of State County and Municipal Employees (AFSCME) reports that Vanguard is the chief enabler among mutual fund companies of excessive executive pay.

Bogle has long pounded the drum over the role mutual funds should play in corporate governance and lamented their lax attitude in rubber-stamping management's proposals, with little thought to the linkage between the impact of their votes and the long-term creation of corporate value.

Mutual funds today own approximately one quarter of all publically traded shares, overseeing and manageding those shares on behalf of the investors in their funds. Bogle believes that mutual fund managers have a duty to vote their shares based on the long-term interests of those investors. Unfortunately, the evidence in this new study shows that this is all-too-rare an occurance for mutual funds.

With CEO pay continuing to reach all-time highs, the AFSCME report examined the proxy votes of the 26 largest mutual fund managers on a selection of corporate compensation-related proposals. The report found that the fund managers supported management-sponsored compensation packages 80 percent of the time, voted against shareholder proposals to rein in pay 52 percent of the time, and voted in favor of directors who failed to gain “significant voting support by shareholders” for compensation-related reasons 55 percent of the time.

The three largest mutual fund managers, Vanguard, Fidelity, and American Funds, who oversee nearly 60 percent of the assets of all 26 firms in the study, were much more likely to vote against shareholder proposals and in favor of the directors. The report found that Vanguard was the biggest “pay enabler,” voting with management in 90 percent of the votes examined, followed by BlackRock and ING. On the flip side, Dimensional Fund Advisors, Dreyfus, and Oppenheimer were the biggest “pay constrainers” of the firms included in the study.

What can investors do? Make sure mutual fund managers know you’re monitoring their approach to corporate governance. Fund managers are required to disclose on their websites how they voted every proxy in every firm they own. And encourage people like John Bogle and others to continue to hold fund managers‘ accountable to their shareholders best interests, not the CEOs and other corporate officers.

Bogle has long pounded the drum over the role mutual funds should play in corporate governance and lamented their lax attitude in rubber-stamping management's proposals, with little thought to the linkage between the impact of their votes and the long-term creation of corporate value.

Mutual funds today own approximately one quarter of all publically traded shares, overseeing and manageding those shares on behalf of the investors in their funds. Bogle believes that mutual fund managers have a duty to vote their shares based on the long-term interests of those investors. Unfortunately, the evidence in this new study shows that this is all-too-rare an occurance for mutual funds.

With CEO pay continuing to reach all-time highs, the AFSCME report examined the proxy votes of the 26 largest mutual fund managers on a selection of corporate compensation-related proposals. The report found that the fund managers supported management-sponsored compensation packages 80 percent of the time, voted against shareholder proposals to rein in pay 52 percent of the time, and voted in favor of directors who failed to gain “significant voting support by shareholders” for compensation-related reasons 55 percent of the time.

The three largest mutual fund managers, Vanguard, Fidelity, and American Funds, who oversee nearly 60 percent of the assets of all 26 firms in the study, were much more likely to vote against shareholder proposals and in favor of the directors. The report found that Vanguard was the biggest “pay enabler,” voting with management in 90 percent of the votes examined, followed by BlackRock and ING. On the flip side, Dimensional Fund Advisors, Dreyfus, and Oppenheimer were the biggest “pay constrainers” of the firms included in the study.

What can investors do? Make sure mutual fund managers know you’re monitoring their approach to corporate governance. Fund managers are required to disclose on their websites how they voted every proxy in every firm they own. And encourage people like John Bogle and others to continue to hold fund managers‘ accountable to their shareholders best interests, not the CEOs and other corporate officers.

Quote of the Day: Ted Nugent

I would like to go on record that the U.S. government is now more offensive and in violation of self-evident truths and God-given individual rights and liberties than the British government was in 1775.

~ Ted Nugent, the entire rant can be found at You have the right to remain stupid

Thursday, July 14, 2011

Quote of the Day -- The Robbery of the Saving Class-- William Ford and Polina Vlasenko

The Fed’s prolonged effort to maintain interest rates at abnormally low levels has deprived savers of hundreds of billions of dollars in interest income, ultimately costing the economy between 2.4 million and 4.6 million jobs, $256 and $587 billion in consumption, and 1.75% and 3.32% in GDP growth.

~ William F. Ford and Polina Vlasenko, from The Downside of Monetary Easing

Wednesday, July 13, 2011

Quote of the Day: Bill Miller

"The S&P 500 is a wonderful thing to put your money in. If somebody said, "I've got a fund here with a really low cost, that's tax efficient, with a 15-to-20 year record of beating almost everybody," why wouldn't you want it?"

~ Bill Miller, Portfolio Manager, Legg Mason, quoted in the Wizards of Wall Street

The Broken Windows Fallacy Revisitied

"Destruction does not create prosperity; destruction destroys prosperity." So the next time your hear a friend or political think there is a silver lining in some natural catastrophe or propose a government program like Cash for Clunkers that destroys property that is still productive remember this video and the broken windows fallacy.

It should also be pointed out that creative destruction is the good one -- destructive destruction is the bad one. Creative destruction is when more efficient, more productive and higher quality goods and services replace less efficient, less productive, lower quality goods and services due to capitalism. This continuous process of renewal is frightening and unpleasant to those in industries that are being supplanted. For instance, no one would argue we should have protected buggy whips or the whale oil industries. Still, these changes were painful for the people working in those industries. Today's buggy whip and whale oils makers would have organized into special interest groups and lobbied for political protection to preserve their way of life.

Creative destruction makes everyone better off in the long run. Stimulus packages and government largesse are the rocks thrown through the panes of progress. Every dollar we spend on something foolish is a dollar we can no longer spend on something productive and prosperity enhancing.

Tuesday, July 12, 2011

Quote of the Day: Matt Ridley

The story of the human race has been a gradual spread of specialization and exchange…. Prosperity consists of getting more and more narrow in what you make and more and more diverse in what you buy. Self-sufficiency – subsistence – is poverty.

~ Matt Ridley, from “Humans: Why They Triumphed.”

Washington Could Learn a Lot from a Drug Addict

A new group called Public Notice Research & Education Fund (PNREF) released this video 3 days ago and it already has over 30,000 views.

Monday, July 11, 2011

NASA Adrift: The Last Journey of the Space Shuttle--- But What's Next?

The Flight of Apollo 11

To the casual observer like myself, NASA has been adrift without lofty goals since the end of the Apollo program. NASA aficionados will no doubt disagree with this statement. However, with the end of the space shuttle program everyone is asking the question-- what's next-- and the silence is deafening. Being a government agency, NASA must get its vision and goals from political appointees and politicians who tend to be backward-looking reactionaries rather than forward-looking visionaries. There's much speculation that NASA has run its course and space exploration will now pass into the hands of the private sector-- companies like Virgin Galatic or SpaceX. Will the US squander its lead in space technology? Let me help the politicians out: In this decade NASA should build a permanent space station on the moon in preparation for colonization of the moon.

Sunday, July 10, 2011

Warren Buffett: How to Solve The Deficit Problem in 5 Minutes

While I admire Buffett's capital allocation skills as CEO of Berkshire Hathaway, I always find it puzzling that he never seems to apply any standards on government spending, where waste, fraud and abuse are well-documented staples. I doubt he or his shareholders would tolerate inefficient capital allocation of this magnitude within his own company. It's also well-known that he feels the wealthy don't pay enough in Federal taxes (see The Grouch's Billionaire Challenge), yet he fails to take advantage of the opportunity to donate to the Treasury to make up for the difference between what he thinks he should be paying in taxes and what he actually pays. In addition, if giving the government more money is morally right and a wise allocation of capital, why did he not donate his fortune to the government instead of the Bill and Melinda Gates Foundation? Is anyone else troubled by these seeming contradictions? In the video above, Buffett does hit upon one of life's eternal truths-- if there is no disincentive for bad behavior then you can expect a lot of bad behavior. As a wise man once said, "Capitalism without bankruptcy is like Christianity without hell." That saying succinctly sums up the economic recession of 2008-10, too big to fail and the ever escalating crisis in deficit spending.

3D Printing Will Revolutionize and Revive American Manufacturing in the 21st Century

Forbes (Rich Karlgaard) -- "The transformative technology of the 2015-2025 period could be 3D printing. This has the potential to remake the economics of manufacturing from a large-scale industry back to an artisan model of small design shops with access to 3D printers. In other words, making stuff, real stuff, could move from being a capital intensive industry into something that looks more like art and software. This should favor the American skill set of creativity."

Amazing, revolutionary potential here for manufacturing and even for medical applications like organ replacement. According to Autodesk CTO Jeff Kowalski, because of 3D printing, "The next five years in manufacturing are going to be substantially different than anything we've seen before. With 3D printing, production and complexity become essentially free. 3D printing will make manufacturing localized, customizable and accessible, with no penalty for personalization or complexity. It's entirely possible that the U.S. could see self-sufficiency and a self-sustaining future."

HT: Carpe Diem

Grouch: Is this the beginnings of the Replicator Machines we saw on TV watching Star Trek as kids?

Saturday, July 9, 2011

Friday, July 8, 2011

Why The Global Warming Agenda Is Wrong

Roy W. Spencer, former NASA climatologist and climate expert, shares his thoughts on the global warming agenda.

Wednesday, July 6, 2011

Letters to Castro: Mario Vargas Llosa's Journey to Classical Liberalism

"Utopia...has always produced the most brutal and criminal regimes."

Tuesday, July 5, 2011

What Could You Do With $278.000?

Once again we get another lesson that Government is not a very efficient allocator of capital. In a new release late Friday ("Seventh Quarterly Report"), the White House Council of Economic Advisors indicated that the stimulus plan saved or created 2.4 million jobs at a cost of $666 billion, or $287,000 per job. A reasonable person just might conclude that the stimulus did little to actually stimulate the economy but had a dramatic stimulative effect on the deficit. In fact, the taxpayers would have saved $247 billion if the government had just written $100K checks to the lucky 2.4 million.

You Know When it's the Devil.........

Dirt Devil-The Exorcist from MrPrice2U on Vimeo.

One of the cleverest commercials around......

Monday, July 4, 2011

The Sorry State of American Education on Display on Independence Day

I'm left speachless at the number of people who no longer understand history and the significance of July 4th.

The Declaration of Independence

The Continental Congress approves the Declaration of Independence, brilliant scene from John Adams mini-series. It is easy to forget these days that the signers of The Declaration were literally putting their lives and fortunes on the line with this vote.

Their example stands in stark contrast to today's timid political "leaders" who are unwilling to put their necks on the line for much of anything, even tackling the #1 threat to the country's well-being: deficit spending.

Sunday, July 3, 2011

Subscribe to:

Comments (Atom)