Tuesday, October 27, 2009

Monday, October 26, 2009

Forstmann on Future of Wall Street

Buyout king and Wall Street legend Teddy Forstmann discusses the future of Wall Street with CNBC's Charlie Gasparino.

Friday, October 23, 2009

Steve Wynn on the Economy, Jobs & Hotels

Steve Wynn talks common sense on deficits and job creation.

How do Harvard Economists Invest?

This article is summarized from the University newspaper The Harvard Crimson.

Greg Mankiw

Mankiw, professor of the largest economics course at Harvard and author of the textbook "Principles of Economics," is a long-term buy-and-hold investor, but does not think he is smart enough to time the markets. His portfolio consists of 2/3 stocks and 1/3 bonds, balancing the higher risk of equities with the steadiness of fixed income. When his portfolio took a hit in the financial crisis, he rebalanced by adding more cash to his equity position. His investments are widely diversified, including international holdings and mainly consist of low-cost index funds. He is invested not only in the US, but in Europe, Asia and the emerging markets.

John Campbell

Campbell, chair of the Economics Department, is an asset pricing specialist and no stranger to active investing, lending his expertise to the hedge fund Arrow Street Capital, and helping to oversee the Harvard endowment fund. With his own money, Campbell avoids stocks and focuses on less risky assets. The article doesn't detail what those assets are, but implies that Campbell may be active in the real estate market. Campbell believes stocks are looking more attractive with the recent rebound in the economy and believes this is a great time for young people to invest.

Claudia Goldin

Goldin, an economic historian specializing in labor economics, comes "from a family of people who are not risk takers," and is well-schooled in the history of hard times. Her approach to investing is very conservative and consists mainly of conservative retirement funds.

All in all, this brief look at three investment styles of Harvard economists left me mildly surprised with their conservativeness when it comes to their own money. My style is most similar to Mankiw, but they all seemed to place an emphasis on balancing capital preservation with growth. No one was a go-go investor, riding the wild swings of the market, hoping to hit a home run. They all seemed to be patient, methodical, almost boring in their investment approaches, which is how investing should be.

Greg Mankiw

Mankiw, professor of the largest economics course at Harvard and author of the textbook "Principles of Economics," is a long-term buy-and-hold investor, but does not think he is smart enough to time the markets. His portfolio consists of 2/3 stocks and 1/3 bonds, balancing the higher risk of equities with the steadiness of fixed income. When his portfolio took a hit in the financial crisis, he rebalanced by adding more cash to his equity position. His investments are widely diversified, including international holdings and mainly consist of low-cost index funds. He is invested not only in the US, but in Europe, Asia and the emerging markets.

John Campbell

Campbell, chair of the Economics Department, is an asset pricing specialist and no stranger to active investing, lending his expertise to the hedge fund Arrow Street Capital, and helping to oversee the Harvard endowment fund. With his own money, Campbell avoids stocks and focuses on less risky assets. The article doesn't detail what those assets are, but implies that Campbell may be active in the real estate market. Campbell believes stocks are looking more attractive with the recent rebound in the economy and believes this is a great time for young people to invest.

Claudia Goldin

Goldin, an economic historian specializing in labor economics, comes "from a family of people who are not risk takers," and is well-schooled in the history of hard times. Her approach to investing is very conservative and consists mainly of conservative retirement funds.

All in all, this brief look at three investment styles of Harvard economists left me mildly surprised with their conservativeness when it comes to their own money. My style is most similar to Mankiw, but they all seemed to place an emphasis on balancing capital preservation with growth. No one was a go-go investor, riding the wild swings of the market, hoping to hit a home run. They all seemed to be patient, methodical, almost boring in their investment approaches, which is how investing should be.

Thursday, October 22, 2009

Frontline: The Warning

Must see TV on the financial crisis..... the failure to regulate and create a market for derivatives, or WMDs as Warren Buffett calls them.

Wednesday, October 21, 2009

Warren Buffett on the Economy

The "Oracle from Omaha" weighs in on what's next in the payment industry and the economy at large. Business Wire CEO Cathy Baron Tamraz sits down with Mr. Buffett in an exclusive PYMNTS.com interview.

Tuesday, October 20, 2009

Jonathan Zittrain: The Web as random acts of kindness

Feeling like the world is becoming less friendly? Social theorist Jonathan Zittrain begs to differ. The Internet, he suggests, is made up of millions of disinterested acts of kindness, curiosity and trust.

Lord Monckton on Climate Change

Feeling like climate change is a scam and the world's leaders are selling out their citizens? Lord Monckton agrees with you and minces no words in making his point.

Sunday, October 18, 2009

The State of the Union

These charts taken from Calafia Beach Pundit show the current Federal Budget situation. By many measures this is the worst situation in the post WWII period, with tax collections as a % of GDP as low as they have ever been, and spending spiraling out of control. The current year's deficit now exceed 11 % of GDP.

If these figures weren't bad enough, just examine the budget projections.

Chilling projections, absolutely chilling that anyone with a conscience would saddle their their constituents with this level of debt or the taxes to fund this debt.

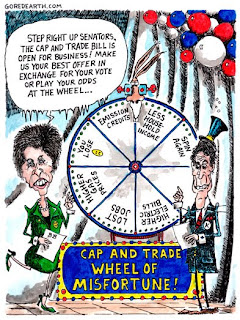

The country needs some smart politicians to put these charts in front of the TV cameras, much like Ross Perot did as candidate for President with his infomercials, and help we the people see the country is on an unsustainable course, and a major reevaluation of the role of government in managing the economy is required. Entitlement programs are already the biggest budget problems, and it is irresponsible for the politicians to push forward with a major new entitlement program that would fundamentally expand the role of government in healthcare and put the taxpayers on the hook for trillions more in expenditures when spending is so far out of control. In addition, embarking on a new set of energy taxes in the form of cap & trade, based on the dubious science of global warming, would only continue to weaken an already weak economy. What's left of the Pokulus Bill should be shifted away from make-work projects, boondoggles, growing state and federal governments, and large scale income redistribution schemes to increased incentives for businesses to hire and invest.

The #1 message all citizens should send to Washington is that it is time to get our fiscal house in order and stop these insane levels of spending. The country simply can't afford it. We need the private sector to help us grow our way out of this mess; continued growth in government will only act like a boat anchor on the economy.

Saturday, October 17, 2009

Portfolio Allocation

One of the most neglected topics on the personal finance blogsphere is asset allocation, and if you believe modern portfolio theory asset allocation this could be one of the most important determinates in portfolio performance. So today I'd thought I'd share with you my personal portfolio allocation. My goals are simply to own most major asset class, be diversified internationally as well as across market caps, and have the traditional 60/40 balanced portfolio split between stocks and bonds. It is designed to help weather downturns in the market, currency risk, country risk and individual security risk, and emphasizes value, small cap, and emerging markets, areas that have historically over long periods of time outperformed the total market.

Is it perfect? I don't think anything is perfect when it comes to investing. But it is something I where can sleep at night and provides returns that are competitive. The shortcomings are that I wish I could find a more broadly diversified international small cap value ETF, and I wish there were more broadly diversified international bond offerings available. As the financial marketplace changes, I'll keep searching for new offerings that better fit my needs and will adjust the portfolio accordingly. Do I have any investments outside of this portfolio? A few... primarily a small position in a commodities ETN that I don't consider a core holding, and some physical gold as a hedge against worse case scenarios.

| Fund Name | Symbol | Asset Class | Target |

| Vanguard Total Stock Market | VTI | LCB | 6.75% |

| Vanguard Value VIPERs | VTV | LCV | 6.75% |

| Vanguard Small-Cap | VB | SCB | 6.75% |

| Vanguard Small Cap Value VIPERs | VBR | SCV | 6.75% |

| Vanguard REIT Index ETF | VNQ | REIT | 3.00% |

| Vanguard FTSE All-World ex-US | EUV | INT'L LCB | 5.40% |

| iShares MSCI EAFE Value Index | EFV | INT'L LCV | 5.40% |

| Vanguard FTSE All-World ex-US Small-Cap Index | VSS | INT'L SCB | 5.40% |

| WisdomTree Int'l Small Cap Div Fund | DLS | INT'L SCV | 5.40% |

| Vanguard Emerging Markets Fund | VWO | EM | 5.40% |

| iShares S&P World ex-US Property Index | WPS | INT'L REIT | 3.00% |

| Vanguard Intermediate Bond Market ETF | BIV | INTER BOND | 10.00% |

| Vanguard Short-Term Bond Market ETF | BSV | SHORT-TERM BOND | 5.00% |

| Nuveen Select Tax Free Fund | NXQ | MUNI BOND | 10.00% |

| iShares S&P/Citi Intl Treasury Bond | IGOV | INT'L BOND | 10.00% |

| SPDR Barclays Cap S/T Intl Treasury Bond | BWZ | INT'L BOND | 5.00% |

Is it perfect? I don't think anything is perfect when it comes to investing. But it is something I where can sleep at night and provides returns that are competitive. The shortcomings are that I wish I could find a more broadly diversified international small cap value ETF, and I wish there were more broadly diversified international bond offerings available. As the financial marketplace changes, I'll keep searching for new offerings that better fit my needs and will adjust the portfolio accordingly. Do I have any investments outside of this portfolio? A few... primarily a small position in a commodities ETN that I don't consider a core holding, and some physical gold as a hedge against worse case scenarios.

Friday, October 16, 2009

Occam's Razor

Developed by William of Occam in 14th century England, Occam's razor reads entia non sunt multiplicanda praeter necessitatem, or in near literal translation entities must not be multiplied beyond necessity. The principle can be more popularly stated as "when you have two competing theories that make exactly the same predictions, the simpler one is the better." How does this apply to investing? Let's attempt to formulate an investment portfolio that provides maximum diversity and covers the major classes of investments in the simplest way. Asset classes I'm interested in include large, mid and small cap domestic stocks, large, mid and small cap foreign stocks, emerging markets, domestic bonds, and foreign bonds. It includes a classic 60/40 split between stocks and bonds, and a 60/40 split between domestic and international.

My sample portfolio looks like:

This simple portfolio is merely an example, not a recommendation, but illustrates how easy it is to achieve diversity by investing in worldwide economic growth, hedging currency risk, individual security risk and individual country risk. Each individual will have to determine the optimum mix of assets for their portfolio. But the simpler the portfolio, the more likely to investor is to stick with the investment program through both good and bad times.

My sample portfolio looks like:

| Fund Name | Symbol | Asset Class | Target |

| Vanguard Total Stock Market | VTI | LCB | 36.00% |

| Vanguard FTSE All-World ex-US | EUV | INT'L LCB | 24.00% |

| Vanguard Intermediate Bond Market | BIV | INTER BOND | 24.00% |

| iShares S&P International Treasury Bond Fund | IGOV | INT'L BOND | 16.00% |

This simple portfolio is merely an example, not a recommendation, but illustrates how easy it is to achieve diversity by investing in worldwide economic growth, hedging currency risk, individual security risk and individual country risk. Each individual will have to determine the optimum mix of assets for their portfolio. But the simpler the portfolio, the more likely to investor is to stick with the investment program through both good and bad times.

Quote of the Day: Marcus Tullius Cicero

Do not blame Caesar, blame the people of Rome who have so enthusiastically acclaimed and adored him and rejoiced in their loss of freedom and danced in his path and gave him triumphal processions.... Blame the people who hail him when he speaks in the Forum of the "new, wonderful good society" which shall now be Rome’s, interpreted to mean "more money, more ease, more security, more living fatly at the expense of the industrious."HT (Maggie's Farm)

~ Marcus Tullius Cicero (106-43 B.C.)

Thursday, October 15, 2009

Investing Using the Principle of Maximum Pessimism/Optimism

Bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria. The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell.This famous quote from John Templeton outlines an investment strategy in broad terms that is counter intuitive to the way most people invest, but if applied properly can reward the patient investor with handsome returns over the years. The difficulty in applying the strategy is controlling investor emotions to not get caught up in the euphoria of a rising stock market and having the discipline to wait for those moments of maximum pessimism or optimism. But one important thing to keep in mind in looking for these opportunities in maximum pessimism is that we are not talking about individual companies, but entire industries or countries where a broad basket of stocks can be purchased to control individual security risk and we are looking for a catalyst to drive these stocks higher.

~ Sir John Templeton

Let's examine some of the moves that Templeton made during his lifetime applying this principle:

- WWII. In 1939 as the Great Depression was ending, WWII beginning, and much of the US was fearful the Depression would deepen, Templeton foresaw the wartime economy would drive up the demand for commodities and industrial materials. As a result he invested $10,000 in104 stocks on the US exchanges trading under $1, 37 of which were already in bankruptcy. As these positions were gradually sold off over the years, Templeton earned a 4 fold return.

- The Rising Sun. In the late 1950's Japan was viewed as a low-wage manufacturer of cheap, shoddy goods. Templeton believed that Japan was committed to growth and quality improvements, and as a result of their improved position in the world economy would have to open up their capital markets to foreigners. In the early 1960's, when Templeton bought in, the Japanese markets traded at a PE of 4 compared to 19.5 for the US with twice the growth rate, 10% verses 4%. From 1960 to 1990 the Japanese index increased 36 times its original value. Templeton sold most of his positions before the market peak when he thought they were fully priced and found better values elsewhere.

- The Regan Revolution and the Return of Optimism. In the early 1980's following the malaise and stagflation of the Carter years, the US was in recession with interest rates raised artificially high to break the back of inflation. At this time many stocks in the US had fallen to single digit PEs, many people thought the US was in decline, and magazines were running headlines like The Death of Equities (a great contrarian indicator). In 1979, the PE on the Dow stood at 6.8, book values around one or less, and almost everyone had given up on the market. With inflation running at double digits, he reasoned the replacement value of assets was much higher than what was carried on the books, and that if corporate profits returned to their historic growth rate of 7% and inflation was reduced to around 5 - 7% that compounded corporate profits could double in 5 years.

- The Internet Bubble. In the go-go 1990's anything associated with the .com revolution commanded astonishing PEs, whether the companies had any sale as assets to back up those stock prices. This was a bubble of historic proportions, similar to the tulip bulb bubble in Holland or the South Sea bubble in England. Maximum optimism is an understatement in describing the valuations of many of these companies. The PE of the NASDAQ had climbed to 151 by 1999. The IPO market for Internet companies was going crazy. Templeton sold these technology companies short, concentrating on the stocks that had risen at least 3x above their offer price and timing his short position days prior to the lockups expiring, giving insiders the right to sell their shares. His reasoning was simple: with little behind these companies other than hype, when the last buyer has bought and no more buyers are left there is only one way prices can go-- down.

- 9/11. Following the horrific attacks on the World Trade Center and the Pentagon, the stock markets were closed for close to a week. Looking to capitalize on the initial panic and subsequent recovery, Templeton did something few would have expected. Believing the government would not let the airlines fail, he placed limit orders on the 8 major airlines at 50% below their pre 9/11 closing price, not as long term trades but short term speculations. Three of these orders triggered and when he sold these stocks in February of 2002, he pocketed gains of 61%, 72% and 24%.

- The Asian Currency Crisis. Triggered by the devaluation of the Thai currency, a chain reaction of selling ran through countries like Thailand, Malaysia, Indonesia, the Philippines, Singapore, and finally South Korea. South Korea caught Templeton's attention, having one of the world fasted GDP growth rates, a high domestic savings rate, and a trade surplus. At the end of 1997, when the country could no longer afford to defend the won, the currency collapsed along with asset values and its stock market. South Korea was forced to go to the lender of last resort, the IMF, who imposed reforms on the country to open up its markets and change many of its traditional labor practices. South Korea also raised interest rates to protect its currency. Templeton began to buy into the Mathews Korea Fund in late 1997, whose 64% decline made it one of the worst perform mutual funds of 1997, viewing that stock market as seriously depressed. The PE of the South Korean market had fallen from 20 to less than 10 because of its poor outlook. In two years, as the country and its markets recovered, and the Mathews fund became one of the best performing mutual funds of 1999, Templeton earned a 267% return on his original investment.

But the question each investor should continuously ask themselves is: do any opportunities exist in the market where maximum pessimism or optimism exist. Today's opportunity may be in shorting bonds. With the Fed discount rate near zero, the weak dollar and steep federal deficits interest rates will at some point in time have to be raising to protect the dollar, combat inflation and keep foreign investors interested in purchasing government debt.

Wednesday, October 14, 2009

WSJ: The Baucus Bill Is a Tax Bill

From yesterday's Wall Street Journal:

My take: Why should anyone be surprised by this? Health care "reform" is not free and will not pay for itself. The savings from eliminating fraud and waste in Medicare will not be achieved. The price tag of $890B will be underestimated by a factor between 2 and 4, and substantial taxes, penalties, fees will be imposed on the middle class to pay for this plan. Those who were counting on getting something for nothing will be in for a rude awakening-- their costs for health care will be greater after the reform than before the reform.

To avoid the fate of the House bill and achieve a veneer of fiscal sensibility, the Senate did three things: It omitted inconvenient truths, it promised that future Congresses will make tough choices to slow entitlement spending, and it dropped the hammer on the middle class.------------------------

One inconvenient truth is the fact that Congress will not allow doctors to suffer a 24% cut in their Medicare reimbursements. Senate Democrats chose to ignore this reality and rely on the promise of a cut to make their bill add up. Taking note of this fact pushes the total cost of the bill well over $1 trillion and destroys any pretense of budget balance.

It is beyond fantastic to promise that future Congresses, for 10 straight years, will allow planned cuts in reimbursements to hospitals, other providers, and Medicare Advantage (thereby reducing the benefits of 25% of seniors in Medicare). The 1997 Balanced Budget Act pursued this strategy and successive Congresses steadily unwound its provisions. The very fact that this Congress is pursuing an expensive new entitlement belies the notion that members would be willing to cut existing ones.

Most astounding of all is what this Congress is willing to do to struggling middle-class families. The bill would impose nearly $400 billion in new taxes and fees. Nearly 90% of that burden will be shouldered by those making $200,000 or less.

It might not appear that way at first, because the dollars are collected via a 40% tax on sales by insurers of "Cadillac" policies, fees on health insurers, drug companies and device manufacturers, and an assortment of odds and ends.

But the economics are clear. These costs will be passed on to consumers by either directly raising insurance premiums, or by fueling higher health-care costs that inevitably lead to higher premiums. Consumers will pay the excise tax on high-cost plans. The Joint Committee on Taxation indicates that 87% of the burden would fall on Americans making less than $200,000, and more than half on those earning under $100,000.

Industry fees are even worse because Democrats chose to make these fees nondeductible. This means that insurance companies will have to raise premiums significantly just to break even. American families will bear a burden even greater than the $130 billion in fees that the bill intends to collect. According to my analysis, premiums will rise by as much as $200 billion over the next 10 years—and 90% will again fall on the middle class.

Senate Democrats are also erecting new barriers to middle-class ascent. A family of four making $54,000 would pay $4,800 for health insurance, with the remainder coming from subsidies. If they work harder and raise their income to $66,000, their cost of insurance rises by $2,800. In other words, earning another $12,000 raises their bill by $2,800—a marginal tax rate of 23%. Double-digit increases in effective tax rates will have detrimental effects on the incentives of millions of Americans.

~ Douglas Holtz-Eakin

My take: Why should anyone be surprised by this? Health care "reform" is not free and will not pay for itself. The savings from eliminating fraud and waste in Medicare will not be achieved. The price tag of $890B will be underestimated by a factor between 2 and 4, and substantial taxes, penalties, fees will be imposed on the middle class to pay for this plan. Those who were counting on getting something for nothing will be in for a rude awakening-- their costs for health care will be greater after the reform than before the reform.

Dr. Ben Carson on Health Care Reform

I encourage everyone to watch this video where world renowned pediatric neurosurgeon Dr. Ben Carson discusses his ideas on healthcare reform. While I don't personally agree with everything he says, he makes a number of good points and is a quiet voice of reason that is well worth listening to in a sometimes raucous public debate. Click on the link below to start the video.

WBFF FOX 45 :: Health Care Reform

WBFF FOX 45 :: Health Care Reform

The Value Added Tax (VAT): A Hidden New Tax to Finance Much Bigger Government

This Center for Freedom and Prosperity Foundation video explains why a value-added tax would be a dangerous money machine for big government. The evidence from Europe also shows that VATs actually lead to higher income taxes.

------------------------------------

My take: IF IF IF IF the VAT were a PERMANENT REPLACEMENT for the personal income tax on all citizens, I would support it. However, the VAT is merely another way to grow government, and find new and creative ways to confiscate more money from the country's producers.

Medical Tourism

The above chart (click to enlarge) shows surgery costs in the US compared to other countries around the world that promote medical tourism. The data is compiled from the Medical Tourism Association site. I assume this may not be an apples to apples comparison, in that additional discounts are usually obtained on the US surgeries by providers and insurance companies. I would treat these as ballpark figures to show relative comparisons.

From the Health Tourism site:

From the Health Tourism site:

- In 2006, about 150,000 American citizens traveled to Latin America and Asia for medical treatment.

- In 2007, the figure increased to approximately 300,000.

- By 2010, experts say the number can increase to over 1 million.

American patients are opting to undergo medical treatment abroad for procedures such as: face lifts, heart bypasses and fertility treatments. For many people who require medical treatment, the last thing they want to do is travel. However, due to the high cost of medical treatment in the USA, many American patients are going abroad for medical treatments. Their purpose is to save 50% to 80% on medical treatment conducted by doctors who are often trained in the United States, at hospitals that maintain the precise standards of patient care and safety.

Canadians Speak Out on Socialized Medicine

Part 1

Part 2

Part 3

Part 4

Michigan's Mackinac Center for Public Policy speaks to Canadians about the quality of their health care system. As America moves closer to a government-controlled health care system, many Canadians want to set the record straight about life under their country's “universal” system. With many Canadians enduring pain for months and years while they wait for surgery, traveling to the U.S. for treatment, entering "lotteries" to get a doctor, and getting "wait list insurance," is Canada really a model for U.S. health reform? You be the judge.

HT (Carpe Diem)

Part 2

Part 3

Part 4

Michigan's Mackinac Center for Public Policy speaks to Canadians about the quality of their health care system. As America moves closer to a government-controlled health care system, many Canadians want to set the record straight about life under their country's “universal” system. With many Canadians enduring pain for months and years while they wait for surgery, traveling to the U.S. for treatment, entering "lotteries" to get a doctor, and getting "wait list insurance," is Canada really a model for U.S. health reform? You be the judge.

HT (Carpe Diem)

Sir James Dyson Reinvents the Fan

This guy continues to amaze me with his inventions, and his spirit to revolutionize the mundane. I hope he turns his skills in the future to home heating and cooling, and revolutionizes the energy footprint of the average house.

Now for an alternative take on Dyson from 4-Block World:

Hulu Desktop for Linux

The Hulu Desktop for Linux is now available and can be found at http://www.hulu.com/labs/hulu-desktop-linux. I downloaded the 64-bit .deb for Ubuntu and installed it with no problems. However, when I went to Applications->Sound & Video->Hulu Desktop, I received an error that the libflashplayer.so could not be found. To fix this problem I downloaded the 64-bit flashplayer off of the adobe site and copied it to /usr/lib/mozilla/plugins. I then edited the ~/.huludesktop configuration file to change the options under [flash] as follows: flash_location = /usr/lib/mozilla/plugins/libflashplayer.so. Hulu Desktop then came up with no issues. Sweet.

Tuesday, October 13, 2009

Quotes of the Day: Thomas Jefferson

He who receives an idea from me, receives instruction himself without lessening mine; as he who lights his candle at mine, receives light without darkening me.

~ Thomas Jefferson

Monday, October 12, 2009

El Rushbo on The Today Show

Part 1

Part 2

Outtakes

Love him or hate him, Limbaugh knows how to draw an audience.

Part 2

Outtakes

Visit msnbc.com for Breaking News, World News, and News about the Economy

Love him or hate him, Limbaugh knows how to draw an audience.

How to Install Google Chrome on Ubuntu Linux

Google Chrome is my favorite browser when I use Windows. But until recently it has been unavailable on Linux. Here are step by step instructions for installing chrome on Ubuntu:

First update your software repositories to include google chrome:

sudo gedit /etc/apt/sources.list

Add the following two lines for Ubuntu 9.04 (Jaunty) Users

deb http://ppa.launchpad.net/chromium-daily/ppa/ubuntu jaunty main

deb-src http://ppa.launchpad.net/chromium-daily/ppa/ubuntu jaunty main

For ubuntu 9.10 (Karmic) Users add the following two lines

deb http://ppa.launchpad.net/chromium-daily/ppa/ubuntu karmic main

deb-src http://ppa.launchpad.net/chromium-daily/ppa/ubuntu karmic main

save and exit the file

Now add the GPG key using the following command

sudo apt-key adv --recv-keys --keyserver keyserver.ubuntu.com 0xfbef0d696de1c72ba5a835fe5a9bf3bb4e5e17b5

Update source list

sudo apt-get update

Install chromium browser using the following command

sudo apt-get install chromium-browser

If you want to open chromium go to Applications->Internet->Chromium Web Browser

First update your software repositories to include google chrome:

sudo gedit /etc/apt/sources.list

Add the following two lines for Ubuntu 9.04 (Jaunty) Users

deb http://ppa.launchpad.net/chromium-daily/ppa/ubuntu jaunty main

deb-src http://ppa.launchpad.net/chromium-daily/ppa/ubuntu jaunty main

For ubuntu 9.10 (Karmic) Users add the following two lines

deb http://ppa.launchpad.net/chromium-daily/ppa/ubuntu karmic main

deb-src http://ppa.launchpad.net/chromium-daily/ppa/ubuntu karmic main

save and exit the file

Now add the GPG key using the following command

sudo apt-key adv --recv-keys --keyserver keyserver.ubuntu.com 0xfbef0d696de1c72ba5a835fe5a9bf3bb4e5e17b5

Update source list

sudo apt-get update

Install chromium browser using the following command

sudo apt-get install chromium-browser

If you want to open chromium go to Applications->Internet->Chromium Web Browser

From the CBO Assessment of the Baucas Health Care Bill

From the CBO assessment of the Baucas Health Care bill:

marginal tax rates would go up by about 22 percentage points for all families whose income was between 100 percent and 400 percent of the poverty level.Is this considered a middle class tax hike?

Saturday, October 10, 2009

What Happened to Global Warming?

With the postponement of the Rockies-Phillies playoff game in Denver due to snow, the early opening of the Rocky Mountain sky resorts, and snow forecast for Chicago on Sunday.... a reasonable person might ask what happened to global warming?

To quote a BBC article:

To quote a BBC article:

This headline may come as a bit of a surprise, so too might that fact that the warmest year recorded globally was not in 2008 or 2007, but in 1998.To read the entire article go here.

But it is true. For the last 11 years we have not observed any increase in global temperatures.

And our climate models did not forecast it, even though man-made carbon dioxide, the gas thought to be responsible for warming our planet, has continued to rise.

So what on Earth is going on?

Climate change skeptics, who passionately and consistently argue that man's influence on our climate is overstated, say they saw it coming.

They argue that there are natural cycles, over which we have no control, that dictate how warm the planet is. But what is the evidence for this?

During the last few decades of the 20th Century, our planet did warm quickly.

Skeptics argue that the warming we observed was down to the energy from the Sun increasing. After all 98% of the Earth's warmth comes from the Sun.

But research conducted two years ago, and published by the Royal Society, seemed to rule out solar influences.

The scientists' main approach was simple: to look at solar output and cosmic ray intensity over the last 30-40 years, and compare those trends with the graph for global average surface temperature.

And the results were clear. "Warming in the last 20 to 40 years can't have been caused by solar activity," said Dr Piers Forster from Leeds University, a leading contributor to this year's Intergovernmental Panel on Climate Change (IPCC).

But one solar scientist Piers Corbyn from Weatheraction, a company specializing in long range weather forecasting, disagrees.

He claims that solar charged particles impact us far more than is currently accepted, so much so he says that they are almost entirely responsible for what happens to global temperatures.

He is so excited by what he has discovered that he plans to tell the international scientific community at a conference in London at the end of the month.

If proved correct, this could revolutionize the whole subject.

Krauthammer: National Decline is a Choice

A snippet of Krauthammer's Oct 5 speech at the Manhattan Institute on foreign policy:

The entire text of the speech can be found here.

HT (Maggie's Farm)

The entire text of the speech can be found here.

HT (Maggie's Farm)

Friday, October 9, 2009

Football Joke: Misunderstanding at Redskin's Park

The Washington Redskins football practice was delayed nearly two hours today after a player reported finding an unknown white powdery substance on the practice field. Head coach Jim Zorn immediately suspended practice and called the police and federal investigators.

After a complete analysis, 20 FBI forensic experts determined that the white substance unknown to players was the GOAL LINE.

Practice resumed after special agents decided the team was unlikely to encounter the substance again this season.

HT (Litherland)

After a complete analysis, 20 FBI forensic experts determined that the white substance unknown to players was the GOAL LINE.

Practice resumed after special agents decided the team was unlikely to encounter the substance again this season.

HT (Litherland)

Barack Obama Wins the 2009 Nobel Peace Prize

This is not a joke. Or is it? Fresh off of being lampooned by SNL as a President who has accomplished two things in office so far, "jack" and "squat," Obama has now won the 2009 Nobel Peace Price for accomplishing jack squat. He is the third sitting President to win this prize, the others being Woodrow Wilson for creating the failed League of Nations, and Theodore Roosevelt for helping end the Russo-Japanese war. The Nobel Committee announcement for Obama reads:

Those Who Were Passed Over in Favor of Obama

Sima Samar, women's rights activist in Afghanistan: "With dogged persistence and at great personal risk, she kept her schools and clinics open in Afghanistan even during the most repressive days of the Taliban regime, whose laws prohibited the education of girls past the age of eight. When the Taliban fell, Samar returned to Kabul and accepted the post of Minister for Women's Affairs."

Ingrid Betancourt: French-Colombian ex-hostage held for six years.

"Dr. Denis Mukwege: Doctor, founder and head of Panzi Hospital in Bukavu, Democratic Republic of Congo. He has dedicated his life to helping Congolese women and girls who are victims of gang rape and brutal sexual violence."

Handicap International and Cluster Munition Coalition: "These organizations are recognized for their consistently serious efforts to clean up cluster bombs, also known as land mines. Innocent civilians are regularly killed worldwide because the unseen bombs explode when stepped upon."

"Hu Jia, a human rights activist and an outspoken critic of the Chinese government, who was sentenced last year to a three-and-a-half-year prison term for 'inciting subversion of state power.'"

"Wei Jingsheng, who spent 17 years in Chinese prisons for urging reforms of China's communist system. He now lives in the United States."

Obama has as President created a new climate in international politics. Multilateral diplomacy has regained a central position, with emphasis on the role that the United Nations and other international institutions can play. Dialogue and negotiations are preferred as instruments for resolving even the most difficult international conflicts. The vision of a world free from nuclear arms has powerfully stimulated disarmament and arms control negotiations. Thanks to Obama's initiative, the USA is now playing a more constructive role in meeting the great climatic challenges the world is confronting. Democracy and human rights are to be strengthened.What a weird last sentence, indicating more hope than change so far. This selection can also be viewed as more of an international repudiation of the policies of George Bush than a celebration of Obama's achievements. Rarely has a person with so few tangible accomplishments, other than giving a few speeches, been awarded a prize this prestigious. Let's hope he has the good sense to turn it down and ask the committee to award the prize to somebody more deserving. But no chance that will happen.

Those Who Were Passed Over in Favor of Obama

Sima Samar, women's rights activist in Afghanistan: "With dogged persistence and at great personal risk, she kept her schools and clinics open in Afghanistan even during the most repressive days of the Taliban regime, whose laws prohibited the education of girls past the age of eight. When the Taliban fell, Samar returned to Kabul and accepted the post of Minister for Women's Affairs."

Ingrid Betancourt: French-Colombian ex-hostage held for six years.

"Dr. Denis Mukwege: Doctor, founder and head of Panzi Hospital in Bukavu, Democratic Republic of Congo. He has dedicated his life to helping Congolese women and girls who are victims of gang rape and brutal sexual violence."

Handicap International and Cluster Munition Coalition: "These organizations are recognized for their consistently serious efforts to clean up cluster bombs, also known as land mines. Innocent civilians are regularly killed worldwide because the unseen bombs explode when stepped upon."

"Hu Jia, a human rights activist and an outspoken critic of the Chinese government, who was sentenced last year to a three-and-a-half-year prison term for 'inciting subversion of state power.'"

"Wei Jingsheng, who spent 17 years in Chinese prisons for urging reforms of China's communist system. He now lives in the United States."

Thursday, October 8, 2009

Defeat The Debt Pledge Commercial

Something serious to think about as government spending continues to spiral out of control. Every dollar in deficits is a dollar+change in future taxes that must be collected or eaten away by inflation.

Government Deficits. Does this scare the crap out of anyone else?

Wednesday, October 7, 2009

Pelosi Floats Idea of VAT to Pay for Health Care

When plunder becomes a way of life for a group of men living together in society, they create for themselves in the course of time a legal system that authorizes it and a moral code that glorifies it. -- Frederic Bastiast (1801-1850)

In a subtle admission that Congress's Health Care proposal cannot be paid for without new taxes, Speaker of the House Nancy Pelosi is at last being honest when she says she that new taxes need to be looked at to pay for these massive new spending programs. However, it is beyond me how a Value Added Tax at every step of the production of a product will level the playing field for American manufacturers. I have trouble getting past the immediate and real impact on American consumers of raising the prices of all American made goods across the board. Even more baffling is her claim later in the interview that this will not raise taxes on middle class Americans. Good grief. Just who does she think is ultimately going to bear the burden of such taxes? The short answer: anyone who buys anything. This type of tax will hurt low income earners the most. The citizens need to start asking themselves some tough questions, like just how of their income should the government be entitled to take.... 30%, 40%, 50%, 60%? And why can't the government stop spending so much money, why can't they control the impulse to spend recklessly and stupidly, why can't the government live within its means and stop pushing the country towards bankruptcy and driving down the value of the dollar. Sneaky forms of taxation like the VAT should be fought against by every citizen.

Tuesday, October 6, 2009

Monday, October 5, 2009

Relooking at Cash for Clunkers

This from today's Wall Street Journal editorial page:

Remember "cash for clunkers," the program that subsidized Americans to the tune of nearly $3 billion to buy a new car and destroy an old one? Transportation Secretary Ray LaHood declared in August that, "This is the one stimulus program that seems to be working better than just about any other program."

If that's true, heaven help the other programs. Last week U.S. automakers reported that new car sales for September, the first month since the clunker program expired, sank by 25% from a year earlier. Sales at GM and Chrysler fell by 45% and 42%, respectively. Ford was down about 5%. Some 700,000 cars were sold in the summer under the program as buyers received up to $4,500 to buy a new car they would probably have purchased anyway, so all the program seems to have done is steal those sales from the future. Exactly as critics predicted.

Cash for clunkers had two objectives: help the environment by increasing fuel efficiency, and boost car sales to help Detroit and the economy. It achieved neither. According to Hudson Institute economist Irwin Stelzer, at best "the reduction in gasoline consumption will cut our oil consumption by 0.2 percent per year, or less than a single day's gasoline use." Burton Abrams and George Parsons of the University of Delaware added up the total benefits from reduced gas consumption, environmental improvements and the benefit to car buyers and companies, minus the overall cost of cash for clunkers, and found a net cost of roughly $2,000 per vehicle. Rather than stimulating the economy, the program made the nation as a whole $1.4 billion poorer.

The basic fallacy of cash for clunkers is that you can somehow create wealth by destroying existing assets that are still productive, in this case cars that still work. Under the program, auto dealers were required to destroy the car engines of trade-ins with a sodium silicate solution, then smash them and send them to the junk yard. As the journalist Henry Hazlitt wrote in his classic, "Economics in One Lesson," you can't raise living standards by breaking windows so some people can get jobs repairing them.

In the category of all-time dumb ideas, cash for clunkers rivals the New Deal brainstorm to slaughter pigs to raise pork prices. The people who really belong in the junk yard are the wizards in Washington who peddled this economic malarkey.

----------------------------------

Couldn't agree more.... a tremendous waste of money and resources. Amazing that this is being touted by the pols as the most successful of the stimulus programs.... makes you wonder what the true negative economic impacts of the other stimulus programs are.

Remember "cash for clunkers," the program that subsidized Americans to the tune of nearly $3 billion to buy a new car and destroy an old one? Transportation Secretary Ray LaHood declared in August that, "This is the one stimulus program that seems to be working better than just about any other program."

If that's true, heaven help the other programs. Last week U.S. automakers reported that new car sales for September, the first month since the clunker program expired, sank by 25% from a year earlier. Sales at GM and Chrysler fell by 45% and 42%, respectively. Ford was down about 5%. Some 700,000 cars were sold in the summer under the program as buyers received up to $4,500 to buy a new car they would probably have purchased anyway, so all the program seems to have done is steal those sales from the future. Exactly as critics predicted.

Cash for clunkers had two objectives: help the environment by increasing fuel efficiency, and boost car sales to help Detroit and the economy. It achieved neither. According to Hudson Institute economist Irwin Stelzer, at best "the reduction in gasoline consumption will cut our oil consumption by 0.2 percent per year, or less than a single day's gasoline use." Burton Abrams and George Parsons of the University of Delaware added up the total benefits from reduced gas consumption, environmental improvements and the benefit to car buyers and companies, minus the overall cost of cash for clunkers, and found a net cost of roughly $2,000 per vehicle. Rather than stimulating the economy, the program made the nation as a whole $1.4 billion poorer.

The basic fallacy of cash for clunkers is that you can somehow create wealth by destroying existing assets that are still productive, in this case cars that still work. Under the program, auto dealers were required to destroy the car engines of trade-ins with a sodium silicate solution, then smash them and send them to the junk yard. As the journalist Henry Hazlitt wrote in his classic, "Economics in One Lesson," you can't raise living standards by breaking windows so some people can get jobs repairing them.

In the category of all-time dumb ideas, cash for clunkers rivals the New Deal brainstorm to slaughter pigs to raise pork prices. The people who really belong in the junk yard are the wizards in Washington who peddled this economic malarkey.

----------------------------------

Couldn't agree more.... a tremendous waste of money and resources. Amazing that this is being touted by the pols as the most successful of the stimulus programs.... makes you wonder what the true negative economic impacts of the other stimulus programs are.

Projected Troubled Asset Relief Program funding of GM, Chrysler, GMAC and Chrysler Financial through June 2009: $79.3 billion. (Source: Statement of Neil Barofsky, Inspector General of TARP, of July 21, 2009. )

GM ownership today: US Government, 60.8%; United Auto Workers Union, 17.5%; Government of Canada, 11.7%. (Source: Edmunds AutoObserver.)

Dr. Soon-Shiong Thinking Out of the Box on Health Care

Dr. Soon-Shiong is spending $1 billion of a fortune he acquired building and selling drug firm APP Pharmaceuticals and hiring the brightest minds in the world to create a smart grid for medical information. He describes it as a “Bell Labs of healthcare”, “a public utility”, and “a medical information superhighway.”

Margaret Thatcher on Socialism

Sometimes I think it would be a breath of fresh air to see the leaders of the US duke it out over policy like they do with the Prime Minister and the House of Commons. Rather than canned, sanitized speeches, a little heated debate might be a good thing to clear the air, and put policies under a higher level of scrutiny.

Next, a retrobite from a CBC Interview with Thatcher from 1983:

My favorite Socialist joke of the moment:

What's the difference between capitalist hell and socialist hell?

In capitalist hell, the damned must lie on a bed of nails while a steam roller drives over them. In socialist hell, it is exactly the same, except sometimes there are no nails, sometimes the steam roller is broken and sometimes the driver is too drunk to work.

Sunday, October 4, 2009

You Know Things Aren't Going Well When SNL Starts Making Fun of You

And now for CNN's comedic attempt to dispute the spoof:

Saturday, October 3, 2009

Quote of the Day: Conservatives & Progressives

The whole modern world has divided itself into Conservatives and Progressives. The business of Progressives is to go on making mistakes. The business of Conservatives is to prevent mistakes from being corrected. Even when the revolutionist might himself repent of his revolution, the traditionalist is already defending it as part of his tradition. Thus we have two great types--the advanced person who rushes us into ruin, and the retrospective person who admires the ruins. He admires them especially by moonlight, not to say moonshine. Each new blunder of the progressive or prig becomes instantly a legend of immemorial antiquity for the snob. This is called the balance, or mutual check, in our Constitution.~ G. K. Chesterton, 1924

A Glorious Dawn - Carl Sagen Remix (featuring Stephen Hawking)

I love this odd music mix from Carl Sagan's TV shows.... it's strangely inspirational, and darn clever, whoever put it together.

If you wish to make an apple pie from scratch, you must first invent the universe.How many people think like that?

Quote of the Day: Blogs, Modern Day Public Square

Whatever the drawbacks and limitations of blogging, it serves, today, as our culture’s indispensable public square. Rather than one tidy ‘unifying narrative,’ it provides a noisy arena, open to everyone, for the collective working out of old conflicts and new ideas. As the profession of journalism tries to rescue itself from the wreckage of print and rethink its digital future, this is where its most knowledgeable practitioners and most creative students are doing their hardest thinking.~Scott Rosenberg, from "Say Everything: How Blogging Began, What It's Becoming, and Why It Matters"

Hat Tip (Carpe Diem)

Is the Stimulous Working?

The above graph from http:innocentbystanders.net shows the projections from the president's economic team forecast in January purporting to show the impact of passing the economic stimulus plan. As you can see, the outcome so far is significantly worse than forecast, with today's announce of the worst official unemployment rate in 26 years of 9.8%, and 17% when you throw in those settling for part-time jobs or those too discouraged to look for work. To my eye, it is significantly worse than the original forecast for doing nothing. Sooner or later, this data will surely be used by politicians in arguments justifying a second round of stimulus. While this data will also be used by critics of the original stimulus to prove that it was nothing but wasteful, pork barrel spending, and not targeted sharply enough in areas of the economy that would be stimulative. I'm sure the administration and their economic team will claim the baseline was significant worse than they thought and the stimulus is working as designed.

For an alternative point of view, here is the controversial Peter Schiff:

William Kamkwamba

A homemade windmill to generate electricity for Malawi, and an amazing young man. The world needs more people like this with vision and a "can do" attitude.

Friday, October 2, 2009

Sticking it to the Man: Nanny State Beer

Earlier this year, British anti-alcohol groups protested the launch of an 18.2% ABV Imperial Stout by the Scottish brewery, BrewDog, flavored with jasmine and cranberries and billed as "the world's strongest beer." By comparison, the average alcohol content of a glass of wine is 11.5%; the average for a glass of sake is 13%-15%; and the average glass of beer 6%-8%.

Earlier this year, British anti-alcohol groups protested the launch of an 18.2% ABV Imperial Stout by the Scottish brewery, BrewDog, flavored with jasmine and cranberries and billed as "the world's strongest beer." By comparison, the average alcohol content of a glass of wine is 11.5%; the average for a glass of sake is 13%-15%; and the average glass of beer 6%-8%.In response to an attempt ban of this controversial brew, BrewDog has created a mild imperial ale called Nanny State with an alcoholic content of 1.1%. The kicker is that the alcoholic content is low enough that it is not regulated or taxed as a beer in the UK.

Bank of America CEO Ken Lewis, Government Whipping Boy

This from the Wall Street Journal editorial page:

"The political class has finally got its man, which is to say that Bank of America CEO Ken Lewis has announced he will retire at the end of the year. Don't you feel better already? Someone had to be sacrificed as expiation for the financial panic and bailout, and the politicians are determined to convince voters that the bankers did it all. So heave-ho, Mr. Lewis had to go.

"His alleged offense—investigated by the SEC, a House oversight committee and New York Attorney General Andrew Cuomo—is that his bank failed to adequately disclose to shareholders potential losses and employee bonuses at Merrill Lynch prior to their December vote to approve the BofA takeover of Merrill.

"Thus the same government that told Mr. Lewis to keep his mouth shut and close the Merrill transaction now says he should have been more candid with shareholders. The same government that also threatened his job if Mr. Lewis didn't accept Merrill's mounting losses along with new federal money—while refusing to provide an agreement in writing because it didn't want to inform taxpayers—now questions the disclosures he made to investors. Too bad the same investigative resources will never be used to find out how financial "systemic risk" was supposed to be reduced by forcing Mr. Lewis to merge the country's largest deposit-taking bank with a failing Wall Street trading firm.

"On the weekend that Lehman Brothers failed in September 2008, could Mr. Lewis have bought a teetering Merrill Lynch for less than he agreed to pay? Probably. Could he have killed the deal or negotiated a better price before the January closing if Treasury Secretary Hank Paulson hadn't pressured him not to make an issue of Merrill's rising trading losses? Perhaps.

"But his real, and ultimately fatal, mistake was to believe the feds when they urged him to buy Merrill—and, before that, Countrywide Financial—in the name of saving the financial system. He forgot the oldest lesson about the second oldest profession: Never trust a politician."

-------------------------------------------------------------------------------

My take is that during his tenure as CEO of BofA Ken Lewis has arguably overpaid for every acquisition he has made to the detriment of BofA shareholders. The two most egregious examples of overpayment are the purchases of Countrywide and Merrill Lynch during the financial which both could have been had for pennies on the dollar if he'd been a little more patient. What I find morally reprehensible is his treatment by the Federal Government and the State of New York after being bullied into buying Merrill Lynch when he knew better by Paulson. Both he and BofA shareholders took one for Team USA by going through with that purchase. Now to have the Feds and pols pressure him out of BofA is nothing short of hypocritical. But what's new.

I'm not defending Ken Lewis here. I think the Board of Directors should have shown him the door a while ago when it became clear his buying sprees and dreams of acquisition grandeur was not adding value to the company. He should be exiting his post based on job performance, not a political witch hunt and as punish for those Merrill Lynch bonus before the acquisition was completed (though that was a dumb move also).

"The political class has finally got its man, which is to say that Bank of America CEO Ken Lewis has announced he will retire at the end of the year. Don't you feel better already? Someone had to be sacrificed as expiation for the financial panic and bailout, and the politicians are determined to convince voters that the bankers did it all. So heave-ho, Mr. Lewis had to go.

"His alleged offense—investigated by the SEC, a House oversight committee and New York Attorney General Andrew Cuomo—is that his bank failed to adequately disclose to shareholders potential losses and employee bonuses at Merrill Lynch prior to their December vote to approve the BofA takeover of Merrill.

"Thus the same government that told Mr. Lewis to keep his mouth shut and close the Merrill transaction now says he should have been more candid with shareholders. The same government that also threatened his job if Mr. Lewis didn't accept Merrill's mounting losses along with new federal money—while refusing to provide an agreement in writing because it didn't want to inform taxpayers—now questions the disclosures he made to investors. Too bad the same investigative resources will never be used to find out how financial "systemic risk" was supposed to be reduced by forcing Mr. Lewis to merge the country's largest deposit-taking bank with a failing Wall Street trading firm.

"On the weekend that Lehman Brothers failed in September 2008, could Mr. Lewis have bought a teetering Merrill Lynch for less than he agreed to pay? Probably. Could he have killed the deal or negotiated a better price before the January closing if Treasury Secretary Hank Paulson hadn't pressured him not to make an issue of Merrill's rising trading losses? Perhaps.

"But his real, and ultimately fatal, mistake was to believe the feds when they urged him to buy Merrill—and, before that, Countrywide Financial—in the name of saving the financial system. He forgot the oldest lesson about the second oldest profession: Never trust a politician."

-------------------------------------------------------------------------------

My take is that during his tenure as CEO of BofA Ken Lewis has arguably overpaid for every acquisition he has made to the detriment of BofA shareholders. The two most egregious examples of overpayment are the purchases of Countrywide and Merrill Lynch during the financial which both could have been had for pennies on the dollar if he'd been a little more patient. What I find morally reprehensible is his treatment by the Federal Government and the State of New York after being bullied into buying Merrill Lynch when he knew better by Paulson. Both he and BofA shareholders took one for Team USA by going through with that purchase. Now to have the Feds and pols pressure him out of BofA is nothing short of hypocritical. But what's new.

I'm not defending Ken Lewis here. I think the Board of Directors should have shown him the door a while ago when it became clear his buying sprees and dreams of acquisition grandeur was not adding value to the company. He should be exiting his post based on job performance, not a political witch hunt and as punish for those Merrill Lynch bonus before the acquisition was completed (though that was a dumb move also).

The World is Flat 3.0

Watch it on Academic Earth

Subscribe to:

Comments (Atom)